As of September 8th, 2023, The Republic of Argentina owes Burford Capital Ltd. about $6.2 billion dollars, two times Burford’s equity market cap. In March 2023, Burford concluded a years long initiative with the SEC applying fair value accounting to litigation finance assets, resulting in restated results from fiscal years 2019 - 2022. Burford’s October 2020 secondary listing on the NYSE kicked-off a somewhat rapid turnover among its shareholder base that in late 2024 will cause The Company to convert to a regular SEC reporting entity. In September 2022, Burford welcomed its third CFO in six years.

Amidst all of the destabilizing characteristics, at $14.34 per share, Burford is a stock worth owning. Here are five reasons why:

YPF Judgement in Hand. Collecting may take years and a substantial haircut. But going forward, Burford will either be owed or have already collected billions of dollars. No other state exists

Complexities Simplifying. The Company weathered covid delays and in 2023 ended a years long process with the SEC applying fair value accounting to GAAP reporting. In Jordan Licht, Burford hopefully has found a CFO worth keeping around and in 2024, The Company will transition to regular way SEC reporting. Becoming simpler is a great way to attract investors

Core Business Worth Owning. Burford’s balance sheet funded litigation finance business, the industry’s cutting edge, is poised to compound at mid-teens or great percentage per year

More Big Wins. The Company is situated to participate in huge litigation efforts, providing valuable optionality to investors

Owner-Operator Leadership. Burford is led by it’s two co-founders, CEO Christopher Bogart and CIO, Jonathan Molot. Bogart and Molot each have significant wealth and reputation invested in Burford yet only control 10% of The Company

My goals in this short write-up are to analyze Burford’s business, describe their YPF claims, measure The Company’s earnings power and assess risks they face. At the end, I talk about my investment and conviction

Table of Contents:

Trading Claims - Burford’s Business

Untendered Shares - Burford’s YPF Claims

What’s Normal Anyway? - Measuring Burford’s Earning Power

Champerty Clamps - Risks Burford faces from Regulation, Competition and Cybersecurity

An Unreasonable Price - Closing Thoughts

Rather than an event trade, Burford is a skewed investment opportunity. I have no idea when or how Burford will collect from Argentina, but I am confident that Judge Preska’s ruling was a one way door and collect Burford will.

Why doesn’t the market agree? Many reasons; Argentina has a well documented history of not paying its creditors and is financially destitute. Burford is a misunderstood or poorly understood business fresh out of Covid and restatement hell, a foreign issuer newly listed on the NYSE. The Muddy Waters short report from four years ago and The Company’s subsequent CFO carousel do not help either!

Its a unique situation and one the market is not used to pricing. Its also a unique situation for Burford, but unlike Argentina, Burford has been preparing for this moment for 10 years.

To understand Burford, you must have an opinion on their YPF claims and on their core business. The former is simple by now, whereas the latter is anything but. That’s where I start, with Burford’s business.

1. Trading Claims

We’re going to talk through a lot of numbers in this section, in hopes of reducing Burford to its core, investing their own money in litigation claims. We end the financial expose with book value per share, the most objective judge of The Company’s record to date. At the end of this section I describe Burford’s capital allocation and administrative decisions that investors should be aware of.

Putting Money to Work

Burford was formed in 2009 to invest in litigation finance assets and that remains The Company’s core business today. Let’s see how litigation finance runs through Burford’s balance sheet:

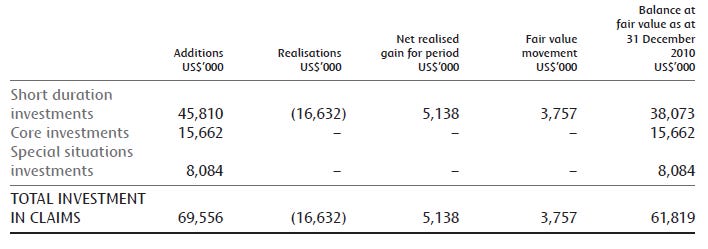

Above, I show the footnotes from Burford’s 2010 Annual Report on top and beneath them, similar footnotes from The Company’s 2018 Annual Report, both detailing additions to and realizations from Burford’s litigation finance asset line item. From 2010 to 2017, the footnote was simple, cash deployed into investments, partial and full realizations of investments, and unrealized gains. In 2017, Burford acquired Gerchen Keller Capital, “GKC”, a litigation finance asset manager. IFRS, the standard that Burford was reporting their financials under at the time, like GAAP, requires that assets and liabilities of managed funds be consolidated with their general partners finances, such that beginning in 2017, Burford began reporting consolidated financials inclusive of GKC funds. Since then, The Company has shared ‘Burford Only’ results, stripping out the effects of consolidating 3rd party funds, in addition to their consolidated results, which we can see in the 2018 footnote above.

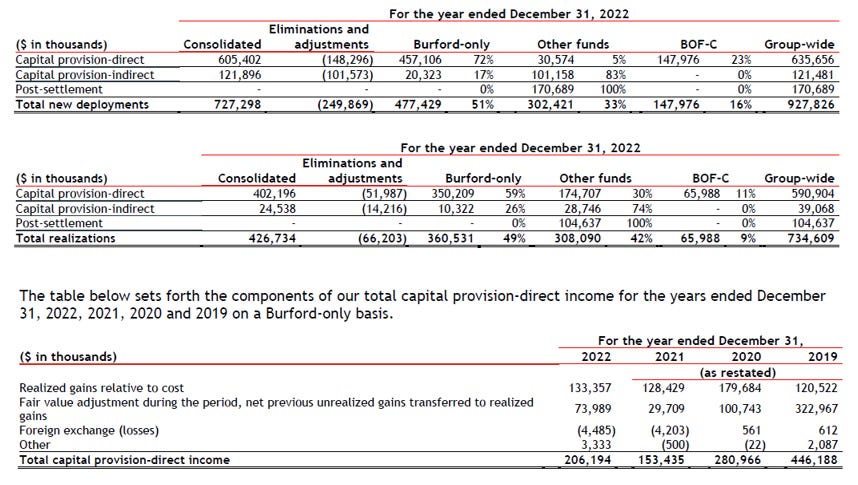

By 2022, Burford reports GAAP financials, more on that later, and all the data points needed for their litigation finance rollforward are available, but scattered throughout the MD&A, which I show above.

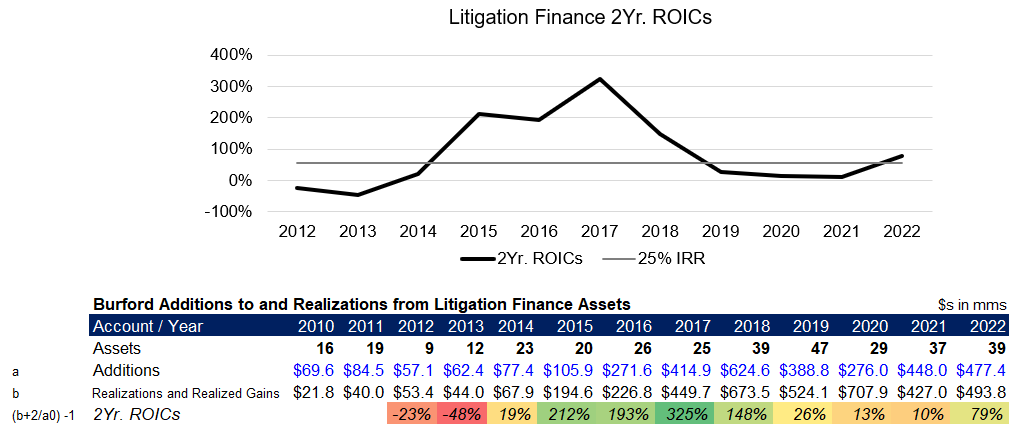

All of this data lets us create a rollforward for Burford’s litigation finance asset and prove out asset level returns on a cash only basis, which I show above. Entries in line a are yearly additions to litigation finance assets. Line b is the sum of partial and full realizations from litigation finance investments. Beneath line b, I calculate ROICs on a 2 year lag, b+2 / a0, beginning in 2012. Cash realizations in 2012 divided by additions in 2010, realizations in 2013 divided by additions in 2011, etc. Why lag by two years? Because Burford’s cases have averaged between 2-3 years, closer to 2, throughout its history. The chart above is a helpful overview of Burford’s asset level returns, which have been all over the place, far above and far below 25% IRRs, where we would expect them to land. I break down the different seasons of Burford returns:

Initial J-Curve, 2010 - 2013. Burford began putting money to work in 2010. As expected, those initial deployments took a few years to generate positive ROICs

Supernormal Returns, 2015 - 2018. Beginning in 2015, Burford began generating extraordinary returns. From their 2015 AR, “2015 brought our largest investment

success ever, a $61 million recovery on a $25 million investment, it also brought a number of other recoveries of varying sizes…”; from 2016 AR, “In 2016 we saw a further acceleration of cash from investment recoveries to record breaking levels”, and from 2018 AR, “…we generated much more cash than ever before…$513mm for Burford’s balance sheet”

Poor Returns, 2019. From Burford’s 2019 AR, “This year was a slower year than last year for resolution of existing business simply because cases didn’t show as much activity as they did the year before”

Covid Lull, 2020 - 2021. Burford’s cash returns suffered greatly during the global pandemic as courts did not operate on their normal schedules. Litigation resolves in two ways, by trial, which were all delayed, or by settlement under the threat of trail, where the threat was removed

“Yea, I’m Thinking I’m Back”, 2022 - Present. By 2022, courts began returning to their normal schedule and Burford’s cash generation followed. In March 2023, CEO Bogart shared,

The courts are back fully in operation…we've got more than 30…final merit hearings or trials already scheduled during the course of 2023, and that compares to only 10 such hearings occurring in 2021 and only 11 last year

Takeaway: Outside of their first few years and Covid, Burford’s litigation finance investments have generated compelling asset level returns, albeit highly inconsistently

Before moving on to expenses, let’s spend a little more time on the assets. In Burford’s early years their counterparties were law firms who could not fund the expenses associated with litigation on behalf of their clients. Burford’s investments covered legal fees in exchange for winnings on a case by case basis. Over the years, Burford’s law firm business grew both as legal expenses inflated and as Burford began financing portfolios of cases from law firms.

In 2015, Burford found a new type of counterparty, large publicly traded corporations, “corporates”. CEO Christopher Bogart explains,

…corporate clients…have valuable claims or pending litigation matters sitting inside the company that are effectively invisible…we don't put those things on the balance sheet for companies. We don't even footnote them…investors don't even know that they're there and…are not likely to do anything other than treat them as extraordinary…gains when they do succeed

…companies have realized that these…assets…can be used today as a liquidity vehicle, by having Burford come along and monetize some of the underlying …value from the claims

- Jonathan Bogart, June 2021

A few years later, Burford identified an additional growth vector, claims families. Claim families describe groups of cases with similar characteristics but not similar enough to be pursued together, as a class. The upshot is scale. After having decided to back a single case, the additional diligence needed to back related claims in the same ‘family’ is marginal, allowing Burford to increase deployments with barely any additional expenses.

The chart above on the left, Assets by Vintage, shows how many deals Burford has invested in each year. Early on, Burford was investing in about 15 deals per year. More recently The company has invested in about 38 deals per year. Wider awareness by counterparties and a larger investment team have allowed Burford to increase their assets by vintage. Above, on the right, I show Burford’s average check size per year based on deployed dollars. Here, we can see the evidence of Burford’s expansion to portfolios of cases first with law firms and then with corporate clients, and of claims families, allowing them to write bigger and bigger checks.

Takeaway: Early on Burford was deploying about 15 $4mm checks per year. More recently, The Company is deploying about 38 $12mm checks per year, a substantial step-up on both accounts.

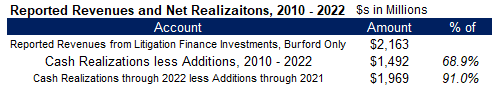

Now that we’ve covered Burford’s cash returns and their litigation finance assets, we need to relate them to reported revenues. Once we have a handle on reported revenues, we can reduce by expenses to end up with net income. Having retained 80% of reported net income since inception, it forms the basis of growth in Burford’s net assets per share, the most objective judge of Burford’s results. The Company reports revenues based on both realized and unrealized gains. In the case of realized gains, both partial and full realizations, revenues are recorded as profits above and beyond each investment’s cost. Burford also reports revenue based on unrealized gains / losses, when court milestones justify a mark-up, as well as due to changing interest rates. This creates a discrepancy between book and cash until the case resolves one of two ways. If Burford wins, they record the investment’s realized profit as revenue, less the non-cash portion already booked. If they lose, the non-cash revenue entry is reversed. Over time, 2-3 years on average, cash and book revenues on a case by case basis reconcile naturally.

The above chart is crucial to me. It shows a clear relationship between Burford’s reported revenues, excluding the effects of consolidation, and their litigation finance assets on a cash basis. From 2010 - 2022, cash explains about 70% of reported revenues. But remember that Burford’s cases take about two years to resolve. Removing just 2022 additions to litigation finance assets takes cash up to 91% of reported revenues. Burford has in the past cited high single digit percentages of revenues attributed to unrealized gains to which my numbers generally agree.

The Cost of Doing Business

We can look at Burford’s expenses three ways. (1) by category / type, (2) by segment and (3) as percentage of assets. For this section, I like (1), to see how Burford spends their money and (3) to see what sort of operating leverage they have found as their asset base has grown. (2) Is not as interesting because no segment besides Burford’s own litigation finance segment has been significant throughout The Company’s history. Later, we will discuss why I do not ascribe any value to Burford’s asset management segment.

The amount of detail Buford has shared regarding their expenses has grown since their early filings and by 2019, The Company’s income statement was broken out thoroughly enough for us to analyze expenses. Similar to alternative asset managers, Burford spends the majority of their operating expenses on compensation. The top line above, total compensation, includes four components; salaries, annual bonuses, stock-based compensation expense and long-term incentive compensation, (“LTIP”). LTIP is paid based on cash realizations and besides 2019, has landed at around 20% of total compensation. Burford’s secondary sales of their YPF stakes in 2019, at huge profits, explain the outsized payments in 2019. More on that soon.

Now let's zoom out a bit and look at expenses as percentages of The Company’s asset base. Above, I show two similar charts, on the left, total operating expenses by year and as a percent of Burford’s total assets. On the right, Burford only litigation finance segment expenses and as a percentage of Burford only litigation finance assets. The two graphs tell the same story, scale. As The Company’s asset base has grown, their expense load, measured as a percentage of assets, has shrunk from high to low single digits. If I had to guess, Burford continues to find operating leverage, expenses as a % of assets will continue to decline, because of growing check sizes, and scale in fixed expenses.

Book Value per Share

Now we can tie it all together; Burford’s litigation finance investments on a cash basis approximate reported revenues which after expenses are what drives growth in book value per share. Since inception, Burford has grown book value per share 6.5x, from $1.64 in 2010 to $10.91 in 2022, a 17.1% CAGR. The Company has also paid a regular dividend since inception, increasing annual value creation to maybe 20%

Next we will dive into Burford’s management / ownership and capital allocation decisions they have made along the way.

Uniquely Capable Leadership

Burford was formed in 2009 by Christopher Bogart and Jonathan Molot. Prior to Burford, Bogart was General Counsel and then an Executive Vice President at Time Warner. Molot was and still is a Professor of Law at Georgetown and is the world’s foremost expert on litigation finance. Bogart and Molot typify the uniquely capable leadership I seek out in businesses to invest in. At just over 40 years old, they joined forces to create at the time the leading litigation finance business in the world. They each own over 4% of Burford’s common stock, worth nearly $300mm in total.

The lion’s share of Bogart and Molot’s work is reflected in the Company’s results I discussed above, but there are many decisions they made along the way and resulting effects that are important for a prospective investor to be aware of. I share them below, grouped into four categories (1) Capital Structure (2) Merger and Acquisition (3) Administration

(1) Capital Structure

Company Formation and Initial Share Sales, 2009 - 2010. Burford was formed in September 2009. In October 2009, Burford sold 80mm shares at 100p and an additional 100mm shares at 110p in December 2010 to end 2010 with 180mm shares outstanding

Asset Manager Internalization, 2012. Burford was initially structured as a pool of assets, litigation finance claims, separate from their asset manager. In December 2012, Burford issued 24.5mm shares to internalize their asset manager, at the time, owned 50/50 by Bogart and Molot

Debt Issuances, 2014 - Present. Starting in 2014, Burford began issuing debt, so far all termed between 7 and 9 years and at a weighted average interest rate of 6.2%. Management is aware of both the risk and reward of taking in debt. The reward is obvious, 6.9% is well lower than Burford’s cost of equity. The risk is obvious too, Burford’s failure to be able to repay principal, hence the long terms. Over 2020 - 2022, Burford’s litigation finance realizations were $700mm, $430mm and $500mm, magnitudes more than the $150mm principle outstanding on The Company’s paper due in 2022 and 2024.

Secondary Offering, 2018. Burford sold 10.4mm shares at 18.50p in October 2018. This was opportunistic, with The Company’s shares trading for around 5x book value, versus the ~1x book value Burford’s stock had traded for previously and subsequently

(2) Mergers and Acquisitions

Firstassist, 2012. In 2012, Burford purchased Firstassist, a provider of litigation insurance in the UK for about GBP20mm. UK litigation insurance at the time was threatened by reforms, causing Firstassist’s private equity owners to sell the business. Burford saw Firstassist as a way to expand their primary litigation finance business into the UK. As it turned out, rumors of UK litigation finance were greatly exaggerated. Burford’s Firstassist acquisition ended up generating an MOIC of 8.4x / IRR of 37% over the next 6 years or so

Gerchen Keller Capital, 2016. Like Firstassist, Burford purchased Gerchen Keller Capital, “GKC”, an SEC registered investment manager, to access a new market, in this case, 3rd party money management. Burford spent a total of $160mm, $138mm in cash and 3.7mm shares worth $22.5m at the time, on GKC, 12.3% of acquired AUM and 37.3x GKC’s trailing net income. Within two years, all of GKC’s principals had resigned, forfeiting a total of 2.5mm Burford shares, see above. Burford’s asset management segment, formally GKC, has scaled AUM nicely, from $1.5B at 12/30/2016 to $3.4B as of 9/30/2023.

But profits have not followed with only $50mm generated in the last 4.5 years. As such, it does not factor into my current view of The Company

(3) Administration

Consolidation of Third Party Funds, 2017. Following their purchase of GKC, Burford’s financial statements consolidated the assets and liabilities of GKC’s limited partner stakes. Similar to other listed asset managers, this causes investors to rely on non-GAAP financials (non-IFRS prior to Burford’s conversion to GAAP) to analyze the general partner’s business on its own

Dual Listing on NYSE, 2020. Burford dual-listed their shares on the NYSE in October 2020 with a direct listing, as opposed to issuing any new shares in conjunction

GAAP Reporting, 2021. Burford first reported GAAP financials in their 2021 Annual Report. They previously reported under IFRS standards

2022 Annual Report Delayed, 2023. In March 2023, Burford announced that they would be delayed in filing their 2022 Annual Report as they continued to a finalize a fair value accounting methodology for litigation finance assets and subsequently restate their prior four years of results in conjunction with The SEC

New Valuation Methodology, 2023. With their release of 2022 Annual Report in May 2023, Burford laid out their new framework for valuing litigation finance assets, based on fair value accounting formulated in conjunction with the SEC. Burford’s old and new methodologies both rely on court milestones as the primary input for increasing valuations. In The Company’s new framework, time and interest rates also are factored into the model

Regular Way SEC Reporting, 2024. Once Burford can attribute 50% of their share registry to purchases through the NYSE, they must switch from a foreign to a regular way SEC reporting entity; 20-Fs and 6-Ks will be replaced by 10-Ks, 10-Qs, 8-Ks, etc. This will nearly certainly happen after 06/30/2024, when The Company next tests

Takeaway: While the past few years have been messy from an administrative perspective, the worst is behind The Company. Burford investors should expect reducing complexity to increase investor demand

Hopefully that is a good overview of the business. In Section 3, I measure Burford’s earnings power and explain how I think about valuation. But before that, let’s dive into The Company’s YPF claims, their claims to fame and tickets to riches.

2. Untendered Shares

My goals in this section are to (1) briefly describe the case itself, Burford’s involvement and current position followed by (2) Share key points and questions for investors to consider

Summary of YPF Case and Burford’s Involvement

YPF Nationalization and Repsol Settlement. In April 2012, Argentina nationalized NYSE listed YPF, a vertically integrated national champion energy business, at the time worth about $10.4B. Spanish energy business, Repsol, was a 57% owner of YPF. 18 months later and after involvement from the World Bank among other international bodies, Argentina paid Repsol $5B as compensation for their YPF shares, a 50% haircut off of the agreed on settlement.

Petersen and Eton Park Lawsuits. Unlike Repsol, The rest of YPF’s owners were not compensated for their shares and two shareholders, Petersen Energia Invesora and Eton Park Capital, sued Argentina for breach of contract in 2015 and 2016 respectively. Enter Burford, who throughout 2016 - 2018 purchased $39mm worth of Petersen and Eton' Park’s YPF claims. From 2017 - 2019, Burford sold down more than a third of their Petersen claims, generating $236mm in proceeds

2023 Rulings in Favor of Plaintiffs. On March 31st, 2023, “…the Court decided that Argentina was liable to Petersen and Eton Park for failing to make a tender offer for their YPF shares….the Ruling was a complete win against Argentina” and on September 8th, 2023, the Court calculated that YPF owed $16B in damages and interest to Petersen and Eton Park collectively. Burford’s share of damages is worth approximately $6.2B, or $28.16 per Burford share

Will Argentina Ever Pay Burford?

In June 2023 during their annual investor relations call, Burford was asked, ‘How likely will Argentina pay the judgement’, to which CEO Bogart responded,

…the obvious answer to the question is that we wouldn't have done the investment and litigated for 8 years, unless we believe that we would be successful in turning an ultimate judgment into a recovery just in the same way that we've been successful in basically every other investment that we've succeeded at. But in terms of how we are going to do that, I'm afraid that has to remain within…the legal teams and not subject for public consumption…

That’s a good place to start. And as of January 10th, 2024, just a few days ago, Burford is free to begin enforcing their judgement, as Argentina failed to pledge assets required by The Court to stave off their creditor in this case. I’m neither a legal nor an asset collection expert. But you don’t need to be. Burford has the judgement in hand. The defendants are not arguing the merits of the case. Interest is accruing at 8% annually. Argentina’s newly elected president, Javier Milie, desperately wants to fix Argentina’s economy. That won’t be possible without satisfying The United States’ Southern District Court judgement.

A payment plan something like the above, 10 bi-annual payments of $550, is how I expect this to ultimately resolve. As a result, Burford may increase their regular dividend and/or use less debt going forward. While buybacks look attractive now, The Company prefers to invest in litigation finance claims and wants more, not less, liquidity for the stock. I am also hopeful that Burford’s shares will be less cheap when this is all put into motion.

Before we measure Burford’s earnings power, I want to end by putting context around YPF as a rule, rather than an exception to Burford’s operations. Later on, we will touch on Burford’s next whale, Sysco. In March 2021, CIO Jonathan Molot described,

…and then with (trials), you have truly outsized returns where you're doing better than tripling your money. That has historically happened in 12% of the capital we've deployed. And this spread of returns, which lead to very high overall IRRs and ROICs across our diverse portfolio can't be attributed to our luck in picking a few good investments, rather it's built into the asset class.

Every case is going to have a distribution of returns, ranging from a loss of your investment to a verdict or judgment, which you not only win on liability, but the judge, the jury or the arbitrator accepts your entire damages theory and awards you everything you were asking for.

…We can't know at the start whether it will settle or go to trial or which category it will fall into. But what we do know is that if we construct the diverse portfolio, the spread of returns will follow….

4. What’s Normal Anyways?

Now to the fun part, measuring the earnings power of Burford’s litigation finance operation. Even as Burford is by definition a specialty finance business, I do not find book value, whether tangible or in total, either excluding or including YPF additive to my investment process. It is interesting to think what Burford’s book of business would be worth at auction, I guess as much as 90% of its carrying value, that’s not what I’m playing for here. The question I am trying to answer is, how many hundreds of millions of dollars of after-tax earnings should investors expect Burford to generate from their litigation finance investments, given their asset base and certain return and expense assumptions?

All About that Base

My goal here is to suss out Burford’s earning power: as of 2023 Q3, investors should expect Burford’s own litigation finance investments to generate somewhere around $235mm in after-tax earnings in the next year. Below, I show my work and as a sanity check, compare to Burford’s reported results. Note, this method includes The Company’s $39mm initial YPF investment, about 2% of cash deployed, but ignores the reward Burford is hoping for from their YPF cases.

The asset base I work off is cash that Burford has deployed into litigation finance assets, plus a percentage of their commitments not yet deployed. multiplied by different portfolio level returns. The results are that Burford’s $1.6B of deployed assets and some small percentage of the $1.5B of commitments not yet deployed translates to asset level returns of $358mm - $628mm assuming 20% - 30% annual asset level returns and 10% - 30% of commitments deployed at those same returns.

Next I want to reduce the cash returns by a normalized expense load for Burford’s litigation finance segment. To do so, I take 2023 H1 Company wide operating expenses and making a few adjustments before annualizing; I exclude (1) a one-time earn-out payment associated with an acquisition, (2) costs associated with The Company’s Asset Management and Other Services segment and include (3) Burford’s net interest expense. I subtract the normalized expenses, with an assumed 12% tax rate, from the asset level returns to end up with earnings powers of about $235mm with wide margins on either side.

Now let’s sanity check. Above, I show Burford’s core litigation finance earnings, excluding YPF gains, from their reported results over the last 7+ years, the same framework I use above to forecast ~$235mm in earnings power. 2017 - 2019 results of $268mm, $339mm and $434mm, justify my estimation. But what about the pittances The Company generated during 2020 - 2023 YTD? Covid. Burford relies on trials to resolve their investments. Under the threat of trial, defendants often choose to settle, but not without trials. Every indication, BESIDES REPORTED RESULTS, are that courts are back at normal schedules, and that Burford will soon see a windfall of realizations, hundreds of millions of dollars they did not collect during Covid.

To end this discussion, I show above the multiple of my estimated earnings power that Burford stock trades at, ignoring their YPF claim as well as any / all delayed realizations. The short answer is that using what I consider to be reasonable assumptions, Burford’s trades for a mid-teens multiple of their litigation finance segment’s current earning power. And an important caveat, Burford nearly certainly will overearn over the next few years as cases that would have been resolved during Covid finally come due. I’m expecting a few hundred million dollars of revenue on top of The Company’s core earnings.

That’s not all. I want to put The Company’s asset management segment into context and explain why I ignore it. In 2022, Burford generated $26mm and through the first half of 2023, $11mm in pre-tax earnings from their 3rd party asset management segment, off of a base of $3.4B AUM. Based on its history of narrow to no profit margin, I do not think the segment deserves an earnings multiple, yet. The segment’s profitability is small enough that just changing an assumptions in the earnings power framework above has more impact than The Company’s asset management segment produces in annual profits. As would a single outsized case win. Which brings us to Sysco.

In June 2023, it became public knowledge that Burford provided $140mm to Sysco Corp., to fund a portfolio of price fixing lawsuits on behalf of Sysco. Burford was actually sued by Sysco, who accused their litigation financier of meddling and preventing Sysco from accepting a settlement. While litigation plaintiffs nearly always retain control of their court cases, in this instance, Sysco provided Burford with veto authority. After losing their lawsuit, Sysco ceded full control of the cases to Burford. But back to the numbers. If Burford’s Sysco cases are successful, the windfall would dwarf earnings from The Company’s asset management segment.

4. Champerty Clamps

Three answers to the question, why might Burford fail are (1) regulation, (2) competition and (3) cybersecurity.

Regulation

Burford is active across Western European countries, in each of the United States and federally, as well as a handful of other countries internationally. Any one of those jurisdictions could limit or forbid outright legal finance. But Burford’s risk is defrayed as no single governing body could limit commercial litigation funding outside of their own jurisdiction. Currently there is no impetus to limit commercial litigation funding, either small-scale or large scale like Burford engages in. There is concern about predatory lending, in the form of litigation finance, provided to individuals. Above, I show a summary of regulatory initiates compiled by Burford’s largest competitor, Omni Bridgeway, more on them shortly.

On the flipside, the United Kingdom and the U.S. states of Arizona and Utah have all broadened rules allowing non-lawyers to own law firms. In 2020, Burford purchased a 32% stake in PCB Litigation LLP, a London based litigation firm, link. In their relatively short existence, Burford has defined the intersection of litigation and finance, by funding legal fees in exchange for upside and then by purchasing litigation assets directly from corporate plaintiffs. Owning law firms is a different structural solution to the same problem, injecting capital into the litigation process. It’s easy to imagine regulation creating opportunities, as opposed to challenges, for Burford, who forever has defined the cutting edge of litigation finance.

Competition

Like other asset classes, litigation finance is a competitive pursuit. Two firms stand out; Burford and Omni Bridgeway, “OB”. Beneath them are a handful of smaller shops with a handful of employees each. As another listed litigation financier, Omni Bridgeway is useful to both compare and contrast with Burford:

Check Size. Burford currently averages $15mm for each commitment they make from their own balance sheet versus Omni Bridgeway’s average investment of $1.5mm, 1/10th the size of Burford.

Capital Structure. OB exclusively invests 3rd party capital versus Burford who invests as much of their own balance sheet into high returning opportunities as possible while reserving lower return opportunities for 3rd party capital

Returns. Smaller check sizes and different capital structures, but Burford and OB’s returns, shown above, are in-line. A simple interpretation is that Burford’s mid 20% returns are more the rule than the exception for litigation finance investment returns these days

Legal contingency fees, when a lawyer shares in the risk of trial, average between 30-40%. So it is not surprising that litigation finance assets generate similar returns. Over time, it seems inevitable that the competitors above, as well as new ones, maybe veterans of Burford, will cause asset level returns to decease as supply of litigation funding increases. That day is far enough away, in my view, to not effect my investment thesis.

Cybersecurity

Cybersecurity is the most potent risk Burford faces. CEO Bogart explains,

What keeps me up at night is a catastrophic information technology breach…It's an area that we designed the business from the ground up around…we have in our files an enormous amount of confidential, sensitive, privilege information about some of the world's largest and most complex litigation matters

…if we were to have a widespread breach of that, and that's not information that's available to a litigation opponent… that would be not good for litigation, were that to become widely publicized

…We have a robust market-leading IT team…we've also designed the architecture to be as secure as one can make it

A breach of Burford’s systems would cripple their reputation and stock price. All company’s these days are at risk of cyber attack. But the consequences for Burford, not only losing a case should public information be disclosed, but the hit to their reputation as a credible funder of litigation’s would be tough to recover from.

5. Cornered Resource

I spent a few weeks unpacking Burford in early 2022 before ultimately passing on the stock, basically crying uncle at the myriad complexities. But, I thought how the stock reacted to the YPF case could provide an opportunity. Here we are.

I’ve been long Burford stock, a 5% position, since 2023 Q4 with an average cost basis in the low $12s. I see the investment as very asymmetric. I expect Burford’s core litigation business to shine, as cases resolve from out of doldrums of Covid delays and as The Company reports clean financials, free of all the complexities miring their reports over the past few years. I expect Burford’s YPF claims to resolve with maybe a 50% haircut, similar to Repsol almost 10 years ago. I have no idea what Burford’s management will do with the proceeds or how the stock will react. But like so many of my investments, its the management and ownership that give me confidence to hold the stock.

‘Why does Pixar retain the Brain Trust?’ Any one of this group would be highly sought after by other animated film companies, and yet…they have stayed with Pixar…in Pixar’s case, the Barrier was personal choice…our general term for this sort of barrier is ‘fiat’; it…comes by decree, either general or personal

Above, Hamilton Helmer describes Cornered Resources, one of 7 Powers he claims explain a businesses success. Burford and their investment operation strike me as a cornered resource that minority investors are lucky to be able to own shares of at current prices. Both Bogart and Molot could of course leave, but their reputations, their legacy and significant wealth, about $150mm each, are tied up in the business they began building 15 years ago. Burford employees can and likely will set up their own shops. But the mothership won’t miss them as they immediately join the fracas of tiny competitors.

I’m not sure what Burford looks like in a few years. I think the stock price will be a lot higher and that's a good place to start!

I circled back and reread this in preparation for the final results this week. I'm glad I did, your piece really works well in breaking down the consitutent parts of the business process, then reassembling them.

I picked up a lot more detail the second time, as well as getting a better handle on the overall framework.

If it seems I'm saying there were any problems first time round, rest assured they belonged to this reader, not the author!