Mark Leonard reported in his 2013 Shareholder Letter, “We achieved a near-record combined ratio (the sum of ROIC and Organic Net Revenue Growth) of 39%…If we had to pick a single metric to reflect the performance of our business, this is the one that we’d choose”. Leonard’s combined ratio is not a metric software companies regularly use; neither Leonard nor Constellation Software, the company he architected, are regular. In maybe a spiritual wink, combined ratio is a metric regularly used in the insurance industry, and for many investors, one they were initially introduced to by Warren Buffett.

By now, Buffett and Berkshire Hathaway are well known. But that was not always true. I often wonder what owning shares of Berkshire Hathaway decades ago felt like and offer that owning shares of Constellation Software, today a company in its third decade, also lead by a business iconoclast, as an answer. Owning Berkshire was a bet on Buffett whereas owning Constellation is a bet on a system designed to allow acquisition activity to scale. Both are capital allocation operations with minimal overhead and decentralized subsidiaries, but they also stand in contrast to one another. Buffett invests across sectors and into both privately held and publicly traded companies while Constellations invests exclusively into vertical market software businesses, with no exceptions to date. Buffett himself has steered Berkshire’s capital allocation while Leonard over 15 years ago began to infuse capital allocation ability throughout Constellation.

In this write-up, I talk through a few layers of Constellation; the businesses Constellation acquires and owns, their founder and President, Mark Leonard, how data informs Constellation’s capital allocation and how capital deployment has scaled with size. Next, I address risks from competition as well as Constellation’s challenge of continuing their growth. I touch on earnings powers and important metrics to monitor and I end with closing thoughts.

Little Castles Everywhere

Understanding Constellation through their electronic health records and point-of-sale softwares

From Process to Partner

Focusing on Constellation’s Strategic Review in 2011 as a lens into Mark Leonard and Constellation’s culture

VMS Laboratories

How Constellation uses data to steer their acquisitions and operations

Loading…

Constellation’s growing acquisition engine

They Can’t Keep Doing This!

Analyzing Constellation’s runway for small VMS acquisitions

Square Peg in a Round Hole

Discussing the Constellation’s risk from competition, and why I am comfortable with it

Bigger Bites, Distressed Assets and Stonks

Examining creative ways for Constellation to deploy capital

Earnings Powers and Expectations

How to measure Constellation and What Happens Next?

Closing Thoughts

Lord knows the world doesn’t need another Constellation write-up. I was inspired to revisit CSI, long a favorite business of mine, after MBI shared his excellent write-up on The Company in May of 2022. I began by rereading each of Mark Leonard’s shareholder letters, as well as all the investor Q&As that Constellation shares. I also undertook a literature review of many great CSI write-ups and analysts who cover The Company and it’s recent spin-outs whom I’ll call out at the end. What I hope to accomplish is:

Share primary source quotations from Leonard’s letters

Reduce, clarify and sharpen my investment thesis

Let’s begin with Leonard describing Constellation’s many verticals strategy in his 2009 letter, written 14 years after founding the business and 3 years after its IPO:

We have been a serial acquirer of inherently attractive small vertical market software businesses in a large number of different verticals. We try to be competent long-term oriented owners of these businesses.

Our maintenance attrition and organic maintenance growth numbers, coupled with our profitability suggest that we have been successful. In the vast majority of cases, the longer we have owned a small software business, the larger and better it has become. If we persist in this strategy (let’s call it the “many verticals” strategy), we will continue to add new verticals and to make many more small acquisitions each year

We’ve handled our geometric growth to date by largely abdicating management to the general managers of each of our vertical businesses. We have a very thin overlay of infrastructure at CSI. We count on the fact that with each new acquisition will come general managers who are steeped in their verticals…

Having owned more than a hundred vertical market software businesses, we also have some best practices that we can share. We coach the managers of our newly acquired businesses in how to grow their businesses and make them even better. As long as we compensate these managers appropriately, and are not tempted to meddle too much, then I think we can scale up Constellation for many years to come.

Fast forward 14 years and Leonard wouldn’t believe his Company’s success. But what about the next 14 years? Constellation has proven their ability to scale M&A, evidenced not just by the amount of acquisitions completed, ~800 since their IPO and ~700 since Leonard’s 2009 letter I quote from above, but also by The Company’s consistent returns on investment and returns on incremental investment, each around 25%, that the Company has earned, suggesting they have maintained price discipline.

Can Constellation continue to purchase small VMS business? The opportunity to continue to purchase small VMS seems large enough to believe Constellation can continue to acquire businesses worth $5-$10mm for a long time. Will Constellation’s activity be threatened by competition? Yes, but not enough to thwart their progress. What are the odds Constellation can expand beyond small VMS deals? Constellation’s own history, recent activity and the current investing climate all suggest that Leonard and Co. will find creative ways to deploy lots of capital, which will be necessary for The Company to continue to grow. And when they can’t grow anymore, I expect The Company to again return capital via special dividend(s).

In his Q3 2007 letter, Leonard presaged,

We believe that long term shareholders will generate a return on their Constellation shares that cannot exceed the sum of long term ROIC plus Organic Net Revenue Growth

So far, Constellation shareholders have enjoyed the same prolific returns the business generated. I don’t expect either to continue, but I do expect The Company to continue to put significant amounts money to work at ~25% IRRs for a long and to be rewarded by greater than market returns from not only a safe but also differentiated investment, as Berkshire proved to be.

1. Little Castles Everywhere

Understanding Constellation through their electronic health records and point-of-sale softwares

Vertical market software (VMS) is software created for industry specific usage. In 2009, Leonard described Constellation’s offerings as,

For an annual cost that rarely exceeds 1% of a customers’ revenues, our products help them run their businesses efficiently, adopt their industry’s best practices, and adapt to changing times…

Nine years later, Constellation executive Barry Symons explained,

…the majority of the markets we serve are not rapidly expanding so the ‘size of the prize’ is not growing significantly

and continued:

the pain of switching a mission critical enterprise application is still high. No matter how fast and cheap computing power becomes people do not like to change things that are working well unless the upside to the change is extremely compelling. Thus I think for the majority of our markets the ‘not worth it’ comment continues to hold and that is evidenced by the limited number of new competitors we see in the majority of our verticals

Constellation sells VMS into over 100 industries but maybe none are more representative of their portfolio than their electronic health records (EHR) businesses. The United States’ Centers for Medicare and Medicaid Services defines EHRs as,

electronic version of a patients medical history, that is maintained by the provider over time, and may include all of the key administrative and clinical data relevant to that persons care under a particular provider, including demographics, progress notes, problems, medications, vital signs, past medical history, immunizations, laboratory data and radiology reports

The EHR automates access to information and has the potential to streamline the clinician's workflow. The EHR also has the ability to support other care-related activities directly or indirectly through various interfaces, including evidence-based decision support, quality management, and outcomes reporting

In 2009 The United States mandated EHR usage by all healthcare providers. A few years later, The Commonwealth Fund published an article by Brian Schilling titled “The Federal Government Has Put Billions into Promoting Electronic Health Record Use: How Is It Going?” with insights into both EHR as well as vertical market software generally,

EHRs can slash drug-drug interaction rates, decrease mortality rates among the chronically ill, cut nurse staffing and lower costs…

Implementing an EHR is not cheap. Cost is frequently cited as the main obstacle to broader adoption of such systems, but it's not necessarily the cost of an EHR system itself that gives many physicians pause. Instead, the more significant cost involved may be lost revenue incurred during the months of preparation, planning, training, and workflow redesign that typically comes with switching to an EHR.

Today, nearly 100% of health systems and medical providers in the developed world rely on EHR systems to provide their services to patients. EHRs are tailored to different business settings, clinical workflows and regulatory compliance requirements. Outside of the clinical operations themselves, replacing an EHR would be the most challenging task for a hospital or doctor’s office. Constellation owns over 20 EHR business, the majority purchased within the last 6 years by their Harris Operating Group.

Beyond EHR software, Harris also owns other mission critical healthcare IT businesses such as:

Iatric, who offers: Accelero Connect, which, “Connects hospital EHR systems to vital sign monitors, smart pumps and other devices…”, FlexButton, which can, “Alert clinicians within their EHR workflow to relevant patient data that resides in other systems, or automatically bring data from other systems into your EHR workflow” and Sedona Learning Solutions, which, “helps you check the EHR training box and improve outcomes – with the least amount of clinical interruption possible”

Picis, whose "perioperative software suite ensures every detail of the patient journey, service provided, and resources used are captured automatically from pre-operative to intra-operative through recovery”

In total, Harris’ Healthcare portfolio is ~25 companies comprised of maybe 50 acquisitions, as acquired businesses acquired businesses themselves and portfolio companies were combined. True to Constellation’s decentralized form both Perseus and Vela, two other Constellation Operating Groups, own four EHR business.

As EHR software is to the healthcare industry, point-of-sale software is to retailers, only without the regulatory imperative. POS systems span a retailers entire business; digital and physical sales, inventory, labor, customers / loyalty, marketing / promotions, taxes and more. Constellation owns at least 16 POS businesses across three of their Operating Groups:

2. From Process to Partner

Focusing on Constellation’s Strategic Review in 2011 as a lens into Mark Leonard and Constellation’s culture

As it’s founder and president, Mark Leonard is Constellation’s functional and spiritual leader. Instead of an overview of his biography or a broad brush across his oversight, I am going to let Mark introduce himself through an excerpt from his 2014 letter and then focus on a episode in Constellation’s history, The Process, to strengthen Leonard’s character.

Leonard recounts,

Last year I asked the board to reduce my salary to zero and to lower my bonus factor. CSI had a great year, so despite those modifications, my total compensation actually increased. This year I'll take no salary, no incentive compensation, and I am no longer charging any expenses to the company. I've been the President of CSI for its first 20 years. I have waived all compensation because I don't want to work as hard in the future as I did during the last 20 years. Cutting my compensation will allow me to lead a more balanced life, with a less oppressive sense of personal obligation.

and explains,

I'm paying my own expenses for a different reason. I've traditionally travelled on economy tickets and stayed at modest hotels because I wasn't happy freeloading on the CSI shareholders and I wanted to set a good example for the thousands of CSI employees who travel every month. I'm getting older and wealthier and find that I'm willing to trade more of my own cash for comfort, convenience, and speed … so I’m afraid you’ll mostly see me in the front of the plane from here on out. I love what I'm doing, and don't want to stop unless my health deteriorates or the board figures it's time for me to go

and gives context,

I’m still planning to do the work that I’ve always done: acquisitions, monitoring, best practice development, investor relations and financing. I’m just not going to do the weekends, all-nighters and a constant grind of 60 hour plus weeks that characterised my earlier career…CSI has lots of seasoned and accomplished managers at the Operating Group level who have become far better coaches, culture bearers, and hypothesis generators than I ever was…One of the results of this compensation change is that I get to side-step the agent-principal problem. My compensation for being president is now tied solely to my current ownership of CSI shares…I'm your partner in CSI, not your employee. I like the feel of the partner relationship a whole lot better…

4-5 years before waiving his compensation and lessening his workload, becoming The Partner, Leonard was navigating Constellation through what he refers to as The Process, “a review of strategic alternatives”, which he qualified for shareholders in his 2010 letter as, “meaning that the company is likely to be sold”.

Leonard introduces The Process in his 2010 letter,

The marketing of the company to prospective buyers has, and will be, a considerable distraction to the managers and employees of the company. We can’t be sure that it will result in an acceptable offer. We hope to get through this process as quickly as possible, generate some liquidity for our major shareholders, and then get back to building our business. This may be my last chance to publicly commend our managers and employees for many years of spectacular performance…I’m proud of the company that our employees and shareholders have built, and will be more than a little sad if it is sold.

Ultimately no sale commenced, likely explained by Constellation’s stock gaining 40% in early 2011 as news of The Process found its way into…the process. Writing again to his shareholders one year later, in 2012, Leonard lamented the toll that The Process took on their business:

…our managers were reticent about adding staff and incremental expense (particularly for long term initiatives) while we were involved in the strategic review process…During the Process our managers were instructed to stop making acquisitions in new verticals. In addition some of the time and attention that might otherwise have been used for acquisitions was diverted into preparing for and responding to potential acquirers of CSI…the Process created a focus on short-term profitability that detracted from our investment in long-term initiatives and from acquisitions that would generate attractive…ROICs.

The Process caused Leonard to reflect on stakeholder management,

When a company is put on the block, employees worry, and trust erodes. It isn't hard to imagine their concerns: Will the current long-term oriented compensation plans be changed? Will independence be constrained? Will their boss be fired? Will they have to fire some mandated percentage of their long term employees? Should they embark on attractive initiatives which will lose money in the short-term? Why do major shareholders want to sell and is there something daunting in the future that the major shareholders see?

Customers rely on us to provide them with the tools to keep their businesses operating efficiently and adapt their information systems to evolving best practices within their industry. They also begin to question their relationships with the company when a potential sale is announced: Will pricing change? Do they need stronger agreements to protect themselves? Will they be dealing with different employees? Will the company have significant debt if it is sold? Will the company continue to invest in its solutions?

And long-term shareholders begin to question their commitment to the company: Is the board exploring a sale because they are concerned about the long-term prospects for the company? Has the company been "optimised", and hence should shareholders sell now before the fundamentals plateau?

Leonard’s respect for his shareholders and reverence for the work his employees perform shines through in his writing and even more so in Constellation’s business and share price results.

3. VMS Laboratories

How Constellation uses data to steer their acquisitions and operations

Constellation meticulously measures their results and using those findings to inform decisions and direction going forward. In his 2014 letter, Leonard detailed,

CSI does have a compelling asset that is difficult to both replicate and maintain: We have 199 separately tracked business units and an open, collegial, and analytical culture. This provides us with a large group of businesses on which to test hypotheses, a ready source of ideas to test, and a receptive audience who can benefit from their application. More quickly and cheaply than any company that I know, we can figure out if a new business process works. This sort of ad hoc experimentation doesn’t require enormous systems or the peddling of a new dogma to the unreceptive. It requires curious managers at a few dozen business units and a couple of clever analysts to plausibly test if a process works.

CSI’s data allows them to operate with internally calibrated base rates,

CSI benchmarks its business units and we share best practices. We usually caveat these practices with phrases like “if you do this, then historically there’s been a Y% probability that Z will happen”, and “this seems to have worked amongst X% of our performing businesses”. Because we have hundreds of similar VMS businesses

Leonard explained in 2015 how Constellation’s IRR data strengthens over time,

When we judge our own track record, we use IRR. We update the IRR forecasts for our acquisitions every quarter. The more “history”, and the less “forecast” that we have for each acquisition IRR, the better a measure it becomes of a manager’s investment performance. It takes years to figure out who are the great capital allocators

In 2007, Leonard explained how Constellation tracks not only investments into acquisitions but also reinvestment into their existing businesses,

In 2003, we instituted a program to forecast and track many of the larger Initiatives that were embedded in our Core businesses (we define Initiatives as significant Research & Development and Sales and Marketing projects). Our Operating Groups responded by increasing the amount of investment that they categorized as Initiatives (e.g. a 3 fold increase in 2005, and almost another 50% increase during 2006). Initially the associated Organic Revenue growth was strong. Several of the Initiatives became very successful. Others languished, and many of the worst Initiatives were terminated before they consumed significant amounts of capital. Examined on a portfolio basis (and to do that we still have to use forecasts, as payback in our business generally requires a 5-7 year time frame) we believe that our Initiatives have generated reasonable internal rates of return. However the Initiative returns have not been as attractive as those generated by our acquisitions. Accordingly, many of our Operating Groups have shifted more of their efforts to growth by acquisition, and have launched increasingly fewer new Initiatives over the last couple of years

Constellation is far from the only business measuring their results and using data to drive decisions. Yet the nature of their operations, systematically buying small business lends itself well to a data driven approach. The company not only avoids poor investments but reinvestments their capital with positive expectations versus their cost of capital as well as against competing internal uses.

4. Loading…

Constellation’s growing acquisition engine

In his 2016 Shareholder letter, Mark Leonard admitted,

Somewhere between mid-2005 and mid-2006, I ran out of capacity. CSI had $200 million in revenue, seven Operating Groups and about thirty BU’s at that time. I could do the short-term BU monitoring portion of the job, but I couldn’t stay abreast of the important longer-term factors for the BU’s…I began to ask our Operating Group Managers to shoulder the entire responsibility for monitoring and coaching their BU’s and to also assume responsibility for deploying the majority of our FCF

Leonard continued,

…the current Operating Group Managers - Barry, Dexter, Jeff, John, Mark, and Robin - have driven most of our capital deployment since 2006. They’ve developed their teams, put their own unique stamp on their groups and done a magnificent job of growing CSI’s revenue and FCF per share by more than tenfold. Each is now running a group of BU’s that is similar in size to CSI when I ran out of capacity. All of the Operating Group Managers have started the process of delegating their monitoring, coaching, and acquisition activities down to their Portfolio Managers, so the cycle begins anew

Constellation is structured with a bare bones head office, lead by Mark Leonard as President and Jamal Baksh as Chief Financial Officer. Reporting into Mark are the six Operating Groups (OGs) referenced above; Harris, Jonas, Perseus, Topicus, Vela and Volaris. Each of the OGs were acquisitions of Constellations that have grown via acquisition themselves.

The chart above, from an excellent overview of serial acquirers by Canuck Analyst, link, shows average EBITDA over three years plotted on the x-axis, bigger companies are further to the right, and the average number of acquisitions over four years are plotted on the y axis, more acquisitions are higher. If you concentrate on the line of central tendency, you’ll see smaller companies making 10 acquisitions per year and the largest less than that. But look up! CSI averaged ~75 deals over four years, about 10x more than their peers!

In his 2015 letter, Leonard explained how capital allocation has moved down the org. chart,

All of the Operating Group Managers have started the process of delegating their monitoring, coaching, and acquisition activities down to their Portfolio Managers, so the cycle begins anew. When I look at the current generation of Portfolio Managers, I see some that have the potential to be exceptional managers and capital deployers…

In December, we asked our Operating Groups to identify new “Potential Portfolio Managers”. The good news was that there were 45 BU Managers on the list…newly identified high potential BU Managers must first demonstrate that they can run a BU well, build a team, and generate optimal organic growth. Then they need to learn some non-trivial M&A skills…If we manage to get even a dozen of these 45 BU managers to the point where they are running 500-1000 employee portfolios in ten years’ time, that will be a huge achievement

From analyzing their public filings, we know that Constellation has successfully trained more capital allocators,

Above, I show capital deployed and number of acquisitions by year on the left. Number of acquisitions increases more evenly than capital deployed, which likely is swayed by one-off larger acquisitions. On the right, I show capital deployed / company wide G&A spend each year. As opposed to total G&A, we’d prefer the denominator to be cost of M&A professionals only, or number of M&A professionals, in which case we’d expect an upward sloping trend. Company level G&A spending is the closest approximation and so I show capital deployed / G&A spending, which has scaled over the last decade plus.

An appropriate next question would be to ask how Constellation maintains their pricing discipline as M&A activity is spread across a wider group. To which Leonard answered in his 2016 letter,

Whether it is a neophyte investment champion arguing that a particular acquisition is “special”, or a senior executive being tempted by a large acquisition, we have enough data to make the discussion rational, not emotional. We all know whether the key assumptions are being pushed to the 55th or 95th percentiles of our historical distributions

5. They Can’t Keep Doing This!

Analyzing Constellation’s runway for small VMS acquisitions

To outside observers, Constellation’s growth over the past decade seemingly defied gravity. In 2022, Constellation’s CFO, Jamal Baksh shared,

We have a database….(with) 40,000 opportunities in it. And we’re constantly adding more…

…we look at the number of businesses that were sold in a given quarter, and for those businesses that are also in our database, we calculate how many of those transactions we were aware of. And what we're finding is we are not aware of close to 70% of the transactions, even though the company was in our database, and we supposedly had a relationship with the company

We are focused on how we improve that coverage ratio from, let's say, 30% to something higher. I don't think it will ever get to 100%, but could it get to 60%? Maybe. And if it does, hopefully, we could deploy twice as much capital.

Unpacking the above and using a few assumptions;

Baksh referenced at least 40,000 which I think, but can’t verify is the same number Constellation shared a number of years prior. Let’s guess the database is actually 20% bigger, 48,000

In 2022, CSI made 143 acquisitions

If we assume that CSI closes on 1% of possible acquisitions, that implies 14,300 businesses as their denominator, 14,300 / 48,000 = 30% of the entire database available for sale

1% is a characteristic close rate I’ve found across successful investment organizations. But 30% of the entire database for sale in a year seems high. Perhaps Constellation is successful at telegraphing the price they’d be willing to transact at, and so:

close 5% of deals, implying 143 / .05 = 2,860 / 48,000 = 6% of all businesses for sale in year. Seems more reasonable from the cheap seats

Constellation’s database is perhaps their least alluring but most effective tool for executing M&A. Building and maintaining relationships over years, while being good stewards of all the other VMS businesses, is a no-nonsense way to attract the right type of seller.

6. Square Peg in a Round Hole

Discussing Constellation’s risks from competition, and why I am comfortable with them

The biggest threat to Constellation is from competition. Competition can have the effect of reducing expected returns from acquisition, by reducing the availability of deals or raising their price, or both. I am going to talk through the threat of competition from the prospective of financial acquirers of VMS software, PE and VC investors, as well as from Constellation’s own employees.

Constellation’s average deal size of ~$5mm for small VMS businesses and their characteristic low revenue growth explains why many PE / VC investors are not interested. Assuming a portfolio size of 12, a PE or VC fund would deploy approximately $60mm and generate annual management fees of $1.2mm at peak, assuming 2% of invested capital. If the portfolio generated 1.5x - 1.75x MOIC over its life, the range for global buyout funds, the fund’s carry would be worth $6mm - $9mm in total. But how would a portfolio of VMS businesses generate such returns? Not likely through revenue growth, as prices generally track with GDP. Big price increases could increase revenue in the short term but would cause many customers to leave, damaging the business long term. Besides raising prices, could financial investors reduce costs? Yes, and similar to price increases, improve the P&L in the short term but at the long term cost of necessary product improvement, which similar to raising prices, erodes the businesses long-term value to another buyer, whom financial investors rely on to make their business model work. Constellation and other vehicles with permanent capital are better structured to recycle the 20% of VMS businesses’ revenues that convert to cash flows than a financial investor. And, we may well look back at 2010 - 2021 as the decade of easy money when competition was most likely to erode Constellation’s prowess, but in this version of reality, did not.

In his 2011 letter, Leonard described the threat of competition from within,

How do we keep these multi-talented managers? Hopefully we provide an environment that is fulfilling, colleagues that are both challenging and entertaining, and work that is meaningful. We also pay them well. They are…millionaires many times over, with much of their net worth invested in unescrowed CSI shares. If they don’t think that CSI shares will generate high rates of return, they need only sell their shares and use their unique skills to deploy and manage their capital. And because the average business that we buy costs something less than $3MM, nearly all of these managers could be in business for themselves very quickly.

I’ve not heard of CSI managers going solo, but of course it has happened and will continue to. Similar to the threat from PE / VC investors, solopreneurs would only compete for a small number of deals. We should expect those with CSI lineage to exhibit both price discipline and operational know-how that they inherited from their prior employer.

If/when the market were to bid up CSI shares, Leonard and Co. would likely see more team members convert to competitors on the margin. Although I do not believe that any share price would cause a noticeable exit. Rather, I guess employees retire regularly, some pursue similar work after Constellation but many do not. I guess that the know-how, people and resources available within CSI are valuable and compel many who would leave under other circumstances not to.

7. Bigger Bites, Distressed Assets and Stonks

Examining creative ways for Constellation to deploy capital

In addition to continuing to acquire little VMS businesses, also crucial to Constellation’s future growth is their ability to deploy capital into distressed assets, large VMS businesses and publicly traded stocks, each of which The Company has demonstrated interest into and proficiency doing. In his 2009 Q1 letter, Leonard shared,

We had comforted ourselves in the last couple of quarters that poor organic growth for Constellation likely meant even worse performance for other vertical market software businesses, and hence we would see a number of good acquisition prospects. This hasn’t proved to be the case.

Many owner-managers of healthy businesses seem to be waiting out the recession before selling, but I had expected some of the leveraged transactions of the last few years to come unraveled. To date, we have seen very few distressed asset sales.

I’m still hopeful that lenders will lose patience with some private equity sponsored vertical market software businesses during the second half of the year culminating in some larger transactions

Leonard went further in his 2012 letter,

The most lucrative acquisitions for us have been distressed assets. Sometimes large corporations convince themselves that software businesses on the periphery of their industry would be good acquisitions. Rarely do the anticipated synergies accrue, and frequently the cultural clashes are fierce, so the corporate parent may eventually choose to sell the acquired software business. The lag is often 5 to 10 years as the proponents of the original acquisition usually have to move on before the corporation will spin off the asset.

Our most attractive acquisitions from corporate vendors seem to have happened during recessions. Occasionally, we also acquire portfolio companies from a private equity (“PE”) fund that is getting long in the tooth. These will have been well shopped but for some reason will not have attracted a corporate buyer. While both corporate and PE divestitures tend to be much larger than the founder businesses that we buy, they are usually more of a cultural challenge for us post-acquisition.

In his 2020 letter, Leonard debriefed shareholders on Constellation’s large acquisition strategy,

For many years, we have tracked large VMS acquisition prospects as a separate segment of the market. We have invested less than 10% of our FCFA2S in this segment, making only three large VMS acquisitions during our entire 26 year history.

Between 40 and 70 large VMS businesses are sold each year. The vast majority of these transactions are marketed to prospective buyers by less than a dozen major merger and acquisition (“M&A”) brokers. Over the last five years, we were aware of about 80% of the large VMS businesses that were sold, but their brokers only invited us to participate in 16% of the sales processes.

We are building a small, dedicated team at head office to pursue large VMS acquisitions and to work with M&A brokers.

Lastly, Constellation has long paid attention to publicly traded stocks. In his 2008 Q1 letter, Leonard reported,

We have bought more than 70 private software businesses outright. On ten occasions, however, we have also participated in the purchase of significant minority positions in public software businesses…

We have the same objective when we buy a piece of a business as when we buy 100%, i.e. we want to be a great perpetual owner of an inherently attractive asset. If we are allowed to join a public company’s board, we offer to sign an agreement that will limit our ability to make an unsolicited take-over bid. This allows existing long-term shareholders of our public investees to continue to enjoy the benefits of ownership.

and shared some drawbacks of Constellation’s public company investing,

they…carry incremental risk because we lack access to information concerning the long term trade-offs that the businesses are making. Even excellent managers of public companies are initially uncomfortable allowing us to join their boards to get access to this information, suspecting us of dire motives or a short-term orientation

In 2015, Leonard again referenced Constellation’s public stock investments,

…we are re-starting our public company investing efforts. During the period from 1995 to 2011, we made sixteen public company investments in the software sector. If you viewed our public company investments as a single portfolio, the internal rate of return (”IRR”) for that portfolio far exceeded our hurdle rate

The average hold period was shorter than we would have liked, and most of the investments ended in the companies being acquired by third parties, rather than CSI

We hope to find some attractive public software company investments in the coming year or two. At present, the pickings are slim due to generally high valuations

Since January 2018, Constellation has deployed ~$2,000mm into carveouts, large acquisitions, spinouts and public stock investments. 2022 brought a handful of conditions that should help Constellation;

Shaky public markets lead to more spin-outs and opportunity for Constellation to buy stocks outright

Higher interest rates reduce attractiveness of PE / VC funds and catalyze distressed sales

Constellation will face intense competition for larger deals. Leonard details three other players in 2016, each of whom are much larger 7 years later,

Externally, competition to buy vertical market software (“VMS”) businesses is intense. Vista Equity Partners and Thoma Bravo are two of the most prominent private equity (“PE”) firms that concentrate on software acquisitions. Roper Industries is a large publicly traded industrial conglomerate that we included in our HPC study and that also actively competes for VMS acquisitions. Vista currently manages approximately $28 billion of capital and Thoma Bravo is managing approximately $16 billion…In the last 9 years, Roper Industries has invested five times as much capital in the VMS sector as CSI has since its inception, 22 years ago

8. Earnings Powers and Expectations

How to measure Constellation and What Happens Next?

Down to brass tacks, how much money does Constellation make and what does its future hold? My goal is to answer the first question by unpacking earnings powers and then calculating return on invested capital and returns on incremental capital invested. We’ll begin with an implicit statement that Leonard poses to shareholders in his 2015 letter,

In assessing CSI’s value, it is tempting to look at cash flows after tax, interest and capex as the “real” return on shareholders’ capital. However, you should only do that if you can convince yourself that the underlying (mostly intangible) assets of our businesses are not deteriorating…If Maintenance Revenue continues to grow organically, there’s reason to believe that our intangible assets are not deteriorating

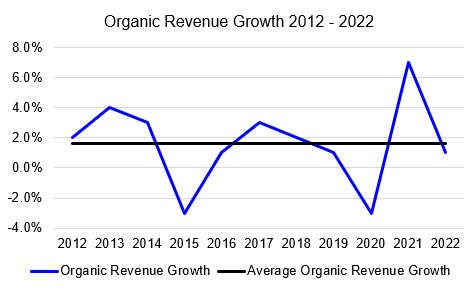

Constellation has generated organic revenue growth between (7.0%) and +7.0% over the last 11 years, with an average of 1.6%, inclusive of FX gains / losses, satisfying Leonard’s warning, at least for me. The implication is that appropriate measures of Constellation’s earnings powers exclude amortization of intangibles associated with their acquisitions. Constellation has shared two different adjusted earnings powers over the years; Adjusted Net Income (“ANI”) through 2018 and Free Cash Flow Available to Shareholders (“FCFA2S”) beginning in 2018, each of which exclude amortized intangibles and are defined fully below. Since 2018, Constellation has adjusted their Cash from Operation down by 25.6% to arrive at FCFA2S. I show the adjustments beneath the FCFA2S definition.

Adjusted Net Income: Adjusted net income means net income adjusted for non-cash expenses (income) such as amortization of intangible assets, deferred income taxes, the Total Specific Solutions (TSS) B.V. (“TSS”) membership liability revaluation charge, bargain purchase gains, and certain other expenses (income), and excludes the portion of the adjusted net income of TSS attributable to the minority owners of TSS

Free Cash Flow Available to Shareholders: Free cash flow available to shareholders ‘‘FCFA2S’’ refers to net cash flows from operating activities less interest paid on lease obligations, interest paid on other facilities, credit facility transaction costs, repayments of lease obligations, the TSS membership liability revaluation charge, and property and equipment purchased, and includes interest and dividends received

Each year, Constellation also shares their own tally of Average Invested Capital, defined below. Growth in invested capital has outpaced FCF recently causing returns on investment to go down. CSI’s 2022 MD&A filing shows that The Company’s Altera acquisition alone reduced ROIC and ROIIC by a few percentage points each. Current trends for each are not encouraging and worth monitoring closely, obviously. I suspect / hope the answer is that invested capital immediately recognizes net income, which has been elevated recently, a good thing, but that the FCF expected to result from the acquisitions made with that net income is lagging

Average Invested Capital. Average Invested Capital represents the average equity capital of Constellation, and is based on the company’s estimate of the amount of money that its common shareholders had invested in Constellation…each period the company has kept a running tally, adding Adjusted net income, subtracting any dividends, adding any amounts related to share issuances and making some minor adjustments, including adjustments relating to our use of certain incentive programs and the amortization of impaired intangibles

Above, I show a summary of CSI’s revenues, ANI, FCFA2S with minor adjustments, average invested capital, returns on capital and 3 year rolling returns on incremental capital. Adjusted Net Income and Adjusted FCFA2S compounded at 16.0%, 14.8% and 18.3% over 3, 5 and 10 years respectively. Three year ROIIC windows ranged from 13.9% to 43.7%. I make two minor adjustments to better reflect Constellation’s subsidiary, Topicus.com (“Topicus”). Topicus is Dutch based owner of VMS businesses that Constellation’s Operating Group TSS merged with in late 2020. In early 2021, Constellation spun out Topicus as TOI on the TSX Venture exchange. Due to their control over the entity, Constellation consolidates 100% of Topicus’ results in their reported financials but removes from FCFA2S FCF owed to Topicus’ other owners; Joday Group and Ijssel B.V.

I add to FCFA2S the share of Topicus’ FCF that Constellation shareholders were dividended, 30.4%. This assumes that CSI shareholders haven’t added to or sold the TOI shares dividended to them. Shareholders who owned Constellation into the TOI spin generate FCF not just from their CSI shares but also from TOI, with no additional invested capital necessary

I remove revenue attributed to TOIs legacy owners, so the margin calculation aligns with my adjustment to FCFA2S above

In March 2023, Constellation spun-out Lumine, a business unit focused on media related VMS businesses, with similar mechanics to Topicus. I will make similar adjustments to account for Lumine in future. The sell-side models CSI on a consolidated basis, including Topicus’ and Lumine’s results within Constellation’s and uses EV / EBITDA multiple on the combined entity as a shorthand for valuation. I prefer using an equity / FCFA2S multiple on each CSI entity as a proxies for going-in yield.

I am not going to share a DCF but will talk through the two most important inputs into a Constellation forecast, organic revenue growth.

Organic Revenue Growth. Two facts are important to remember regarding The Company’s organic revenue growth (1) to the extent Constellation buys distressed assets, their organic revenue growth will be be lower, but not their IRRs (2) Some may judge Constellation’s near zero revenue growth, particularly versus other public software companies. But, if you believe Constellation, their anemic, but greater than zero, revenue growth is their correct optimization of price / churn / internal investment that results in the highest IRR, not revenue growth

FCF Deployment. If CSI slows their FCF deployment, not only will future earnings and growth in earnings slow versus history, but the market’s perception of CSI’s terminal value will shrink, rightly so. Investors will be challenged gauging whether CSI’s slowing capital deployment is a short term lull or their last plateau. On investing outside of VMS, Constellation CFO Jamal Baksh shared in 2022,

Mark also started to put some effort around investing outside of VMS. In terms of where or will we be able to invest outside of VMS, I'd just say it's going to be extremely difficult to find an area where we can invest large amounts of capital outside of vertical market software. I tell investors, I would not factor that into any modeling that you're doing for the company

In 2019, Constellation returned ~$400mm to shareholders via a special dividend. I expect The Company to do so again when circumstances dictate. In response to an investor asking what the dividend signaled, Leonard responded,

The dividend is clearly a signal about capital deployment. If we thought that we could deploy this capital at high rates of return, we would have kept it

9. Closing Thoughts

on owning Constellation Software

Constellation is both an exceptional company and an exception in the public markets. To wit, The Company’s bonus plan dictates that,

at least 25% of the incentive compensation for the majority of our senior employees who earn in excess of $75,000 per annum and have bonuses in excess of $10,000 per annum be reinvested in shares of the Company that are subject to restrictions on resale for a period of three to ten years. At a minimum, these restrictions require employees to hold 100% of their shares for the first two years following acquisition, and then one third of such shares may be sold in each of years three, four and five. Senior executives are required to invest 75% of their bonus in shares of the Company that are subject to the same restrictions on resale for a period of three to ten years. Once every five years, employees may elect to receive 100% of their bonus in cash

Leonard described the conditions giving rise to that class of Constellation employees in his 2015 letter,

Only our BU managers have the intimate knowledge of their markets and teams needed to intelligently trade-off short term profitability and long term growth when they choose to sponsor an Initiative. Only they can deliver the “synergies” required to justify the acquisition of a high growth potential add-on products/services company. So if we are going to delegate the responsibility for organic growth and some of the acquisitions to the BU managers, how do we go about attracting and keeping great BU managers?

Our best BU managers have overseen double digit rates of growth for years via a combination of organic growth and acquisitions in their vertical and in adjacencies. That kind of low capital intensity compound growth creates powerful economics that generate remarkable incentive compensation. For BU managers that are new to the job and running a single BU, the compounding effect isn’t as obvious, so we’ve started to roll out an additional bonus program targeted at keeping this contingent around until their wealth building potential becomes apparent. To date there are over 100 CSI employee/shareholder millionaires. Ten years from now, my hope is that there will be five times as many

In addition to employee/shareholder millionaires, named executive officers who are also directors own at least 6.4% of shares outstanding. I suspect that share ownership among CFO, Jamal Baksh, Harris CEO, Jeff Bender, and Topicus CEO, Robin Van Poelje, are understated to a degree due to estate planning techniques that have shifted shares outside the requirements of the Ontario Securities Regulator. It is also possible / likely they each have sold a significant amounts of their shares. The overall effect is that some high single digit percentage of Constellation shares are owned by employees. Each year there is a mandate for more buying as part of the bonus program. That, combined with the businesses’ performance has resulted in a stock chart with famously few drawdowns.

One last exception is the spin-outs. Constellation has now twice used minority interest in a newly formed public listing as currency to complete large acquisitions; TSS’s purchase of Topicus in early 2021 and Lumine’s purchase of WideOrbit in early 2023. Constellation’s shareholders received shares of both Topicus and Lumine via dividend while Constellation maintained minority ownership with control through super voting shares in each case. The spin-outs allow CSI to take bigger bites, requisite for their growth, but also complicating the analysis of their business(es), for better or worse.

As Berkshire is cast in Buffett’s image, so is Constellation in Leonard’s. Leonard’s fascination, VMS businesses, are higher IRR opportunities than Buffett’s wide and evolved interests, But Buffett’s picks are ultimately higher ROIC investments given their duration. Berkshire’s insurance conglomeration, certain of Buffett’s stock picks, and their regulated utilizes; BNSF and BHE, all will outgrow and outlast most of Constellation’s subsidiaries. I guess that’s how the story ultimately ends, with Buffett’s and Leonard’s writings being their strongest link as Constellation does not stray from investing meaningfully outside of vertical market software.

Below are a handful of analysts who cover or have written up Constellation who’s work and which I heartily recommend:

Mostly Borrowed Ideas, a fantastic overview including a detailed model

10th Man blog has covered Constellation, Topicus and Lumine in depth and has shared detailed

Leandro from Best Anchor Stocks keeps up with Constellation and Topicus quarterly and I may pick up coverage of Lumine

Andvari Associates wrote a short piece in the thoughts section of their website describing Constellation’s metals / mining VMS complex which inspired me to go deep on their EHR and POS businesses

LibertyRPF follows Constellation closely and writes up The Company regularly in his emails, which I highly recommend subscribing to and paying for

Edelweiss_Cap, who just recently shared a piece on Constellation included a scenario analysis tying required return to FCF deployment over the next five year

This was a great read, thank you Andy!

Great write-up, thank you Andy !