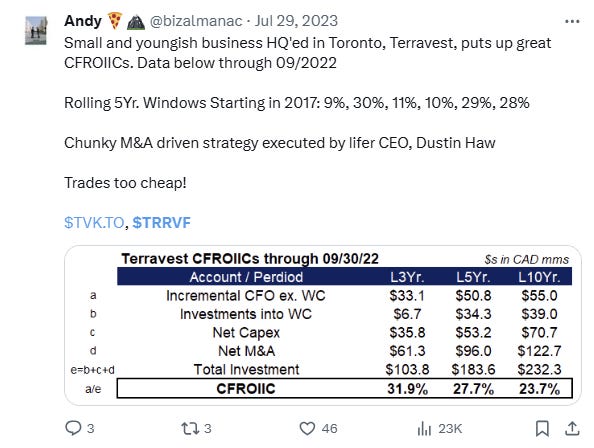

In June 2023, I shared my Terravest thesis in a Tweet, above. The Company, led by impressive CEO, Dustin Haw, generates attractive returns, increasingly so, by deploying the cash flows generated from their portfolio of cyclical, low-growth and no-growth energy industrial and energy service businesses into acquisitions of more of the same. And the stock was too cheap at the time.

To me, too cheap was a high-single digit EV to EBITDA multiple, translating to a mid-teens equity multiple of free cash flow. My personal timeline with Terravest is, (1) Late 2022, I finally listened to a friend who had been suggesting I look at The Company (2) January 2023, First 1-1 with CEO Dustin Haw. Really positive interaction, he knows what game(s) he was playing and the maths associated with them; running existing businesses for cash flow and reinvesting in new ones at *very* low multiples/ high returns (3) March 2023, stink bid hit, TVK 5% position, (4) June 2023, send tweet (5) October 2023, after thinking on it for a bit, increase position size to 10% (6) August 2024, Share “IRR, irrespective”, my first write-up on Terravest.

Since then, TVK.TO has gone up, a lot. I will address that. But before, I update The Company’s results through their FY2024, the twelve months ended on 09/30/2024 and that they reported out on December 13th. I'll do so roughly in the same order I presented them in, “IRR, irrespective”. Along the way, I add commentary and answer whether the new results effect the investment case, if at all

Up and to the Right - Results update

Up and Out - Stock price ramifications and other considerations

Onwards and upwards - Portfolio considerations and stray thoughts

The stock price effects the investment thesis, both in obvious and less obvious ways, which I unpack in section two. I end with a discussion around where Terravest fits in my portfolio and thoughts on at least two other businesses, MATTR and Apollo.

Programming notes. All dollars are in CAD. All years are Terravest fiscal years that end on September 30th of that calendar year. Also, this is not a quarterly update, or an ‘earnings review’, rather just continuing to monitor Terravest over the long term and taking an excuse to spill some ink 🖊️