Sunnier Days Ahead

Incorporating Bridge's 2023 Q2 Results

In my last write-up, “In the Eye of Three Storms”, I asked and answered:

So why has both Bridge’s business and stock suffered recently? The business has been in the eye of three storms; (1) Increase in interest rates, (2) BREIT drama and (3) regional bank crisis.

Two of the storms, BREIT drama and the regional bank crisis, have waned while The Fed. appears to be close to the end of their rate hikes. Bridge’s business and stock seemed to have bottomed in 2023 Q2. Sunnier days are ahead.

My goals in this short write-up are to:

Remind you why I’m excited about Bridge

Update my forecasts for Bridge’s business and stock

Comment on Bridge’s fundraising efforts

Comment on Multifamily Fund V performance

Share soundbites on how Bridge is participating in various markets

Discuss risks

I like investing in alternative asset management businesses. Investors of all types have already or are in the process of diversifying their portfolios from stocks and bonds to include alterative assets. Real estate is a welcome addition to many portfolios, improving yields versus fixed income, diversifying away equity beta and protecting against inflation. Bridge is a dedicated real estate investment and asset management business with three flagship real estate investing verticals; Debt Strategies, Multifamily and Workforce & Affordable Housing, 8 burgeoning real estate platforms and a fourth flagship vertical in the form of Newbury Partners, a private equity and credit secondaries firm Bridge acquired in early 2023.

As I detailed in my last write-up, Bridge’s business was hampered as the Fed. raised interest rates, as Blackstone’s BREIT fund gated redemptions and most recently during the regional bank crisis of early 2023. Now, halfway through 2023, it seems that the challenges have subsided and that Bridge’s stock first and then business both bottomed.

In conjunction with a re-awakening real estate market, Bridge is entering an enviable fundraising schedule. The Company is already fundraising for Newbury Fund VI and just announced that they will begin fundraising for Debt Strategies V and Workforce & Affordable Housing Fund III.

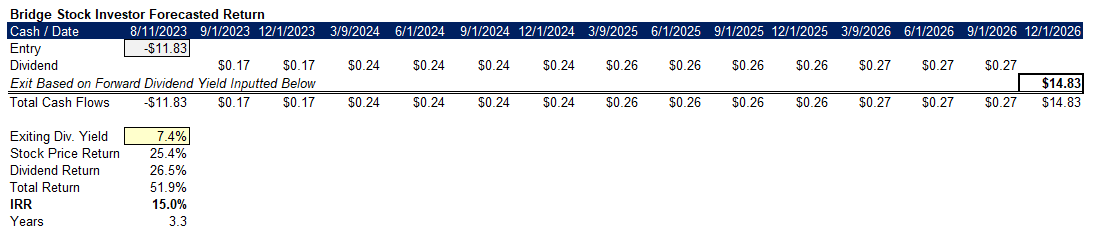

Owning Bridge’s stock is easy here. I provide a detailed model showing that with conservative but reasonable fundraising guesses, investors can expect to generate a 15% annualized return through December 2026 assuming a 7.4% dividend yield at exit. But I bet we’ll do better with signs of life from the real estate market spurring investor demand both into Bridge’s funds as well as their stock.

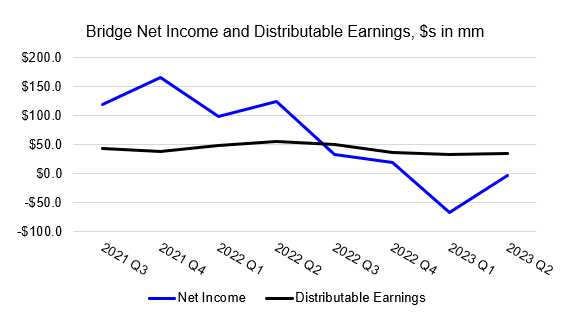

I show the chart above, Bridge’s GAAP net income in blue and Distributable Earnings, “DE”, cash net income inclusive of realized performance fees, for two reasons: (1) The black line, DE, is the underlying business, incredibly stable thanks to contracted management fees and (2) the disconnect between GAAP net income and DE weights on the stock in the form of a complexity discount, but also provides opportunities thanks to mispricing. My framework for forecasting Bridge is simple; FEAUM → Revenues + Realized Performance Fees → Distributable Earnings → Dividends.

A note, I discuss FEAUM throughout the article. In Bridge’s case, FEAUM stands for fee-earning assets under management. These are the dollars they are charging fees against. When Bridge talks about AUM, those refer to the entire capital stack of the properties they invest in / manage, inclusive of third party mortgage debt.

2. Update My Forecast for Bridge’s Business and Stock

Fundraising is the major input into my forecasts for Bridge’s business and with three of four flagship funds set to launch new vintages in 2023, why I remain excited about Bridge’s stock.

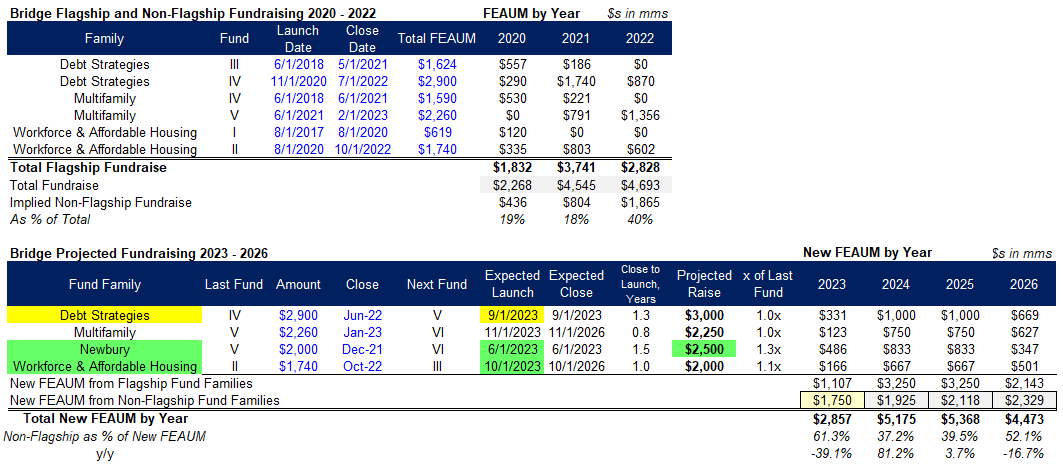

In the top table above, I show each of the prior two vintages of Bridge’s three flagship fund families, excluding Newbury, the secondaries asset manager Bridge acquired in 2023. In the lower table, I forecast fundraising from each of Bridge’s four flagship fund families, including Newbury, as well as from Bridge’s ~8 other investing platforms as a group, by year. Notes below:

In early June 2023, Bridge confirmed that Newbury is raising their Fund VI and targeting $2,500mm, whereas I previously guessed they would raise $2,250 starting in August 2023, link

In their 2023 Q2 conference call, Bridge indicated that their Debt Strategies and Workforce and Affordable Housing funds will begin raising their Fund V and Fund III respectively. I pushed back my forecasted date for Debt Strategies V to 09/01/2023 and kept WF&AH as a 10/01/2023 launch

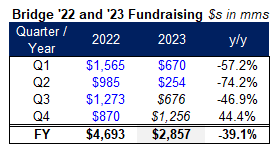

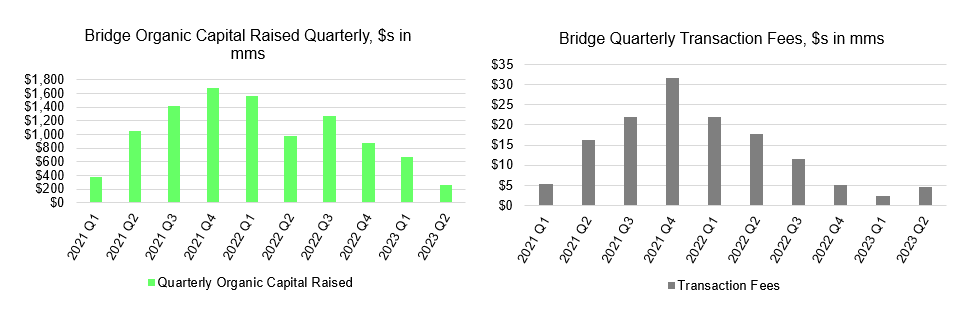

As a gut check, I take my total 2023 fundraising guess, $2,857mm, and compare vs. 2022 on a quarterly basis, using actuals for Q1 and Q2 and the implied back half of 2023, which I guess is weighted 65% in Q4, thanks to Debt Strategies V and WF&AHIII launches. Here is where we find Bridge, with fundraising down 57% and 74% year over year in 2023 Q1 and 2023 Q2 and projected to be down 39% in 2023 vs. 2022. But, the real estate markets seem to reawakening just as Bridge begins raising new funds in three of their four flagship fund families and as other investing platforms gain scale, notably AMBS and logistics.

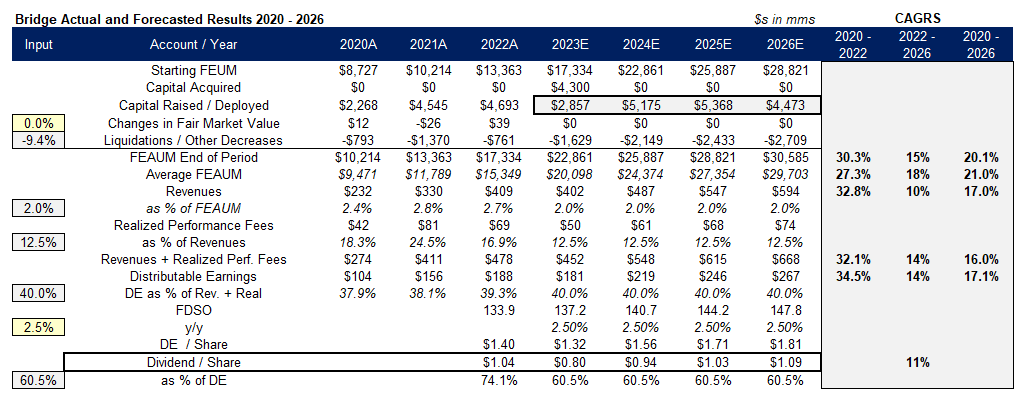

I drop my forecasted funds raised into my model above, with FEAUM → revenues and realized performance fees → distributable earnings → dividends. The only change to my inputs above, besides the reduced fundraising flowing through, is to expect Distributable Earnings margins of 40%, as opposed to 38.5% previously. In their 2023 Q2 earnings call, Chairman Bob Morse commented,

…we have a number of newer organic strategies that have yet to achieve positive FRE, but are well positioned to scale over time. AMBS and Net Lease Industrial Income are reaching critical mass in AUM and moving closer to profitability

Asset management businesses are extremely scalable, and so not expecting any margin expansion, as Bridge invests into their eight non-Flagship investing platforms, is punitive, whereas I think adding 150bps is conservative.

When I last forecasted Bridge’s stock returns, I didn’t assume any multiple expansion, rather that investors would exit their position at a dividend yield equal to entry. But Bridge’s stock is now more expensive, with earnings and dividends falling more than the stock. In response, I’ve changed the framework of my forecast, to ask, what forward dividend yield could an investor exit at and generate a 15% annualized return? Above, I show that after collecting $3.14 in dividends over 3.3 years, a Bridge investor could sell their shares at a forward dividend yield of 7.4% and generate a 15% annualized return.

3. Comment on Bridge’s Fundraising

Bridge raised $254mm in 2023 Q2, The Company’s worst quarterly showing ever. $254mm is 62% worse than Bridge’s fundraising from 2023 Q1 and 74% worse than 2022 Q1. Below, I share some quotes from Bridge’s most recent earnings call below underscoring their optimism that the rebound in commercial real estate has begun. I won’t go that far, but I am at least confident that lows in both CRE transactions and in Bridge’s stock price have been established.

Chairman Bob Morse shared,

In the 3 months since our last earnings update, we have seen an improvement in the macroeconomic environment and activity levels beginning to recover at adjusted and attractive prices in the U.S. real estate markets

CEO Jonathan Slager added,

Bridge is beginning to see some renewed activity despite the fact that Q2 commercial real estate transaction volume remained at the press levels as higher interest rates and volatility within the debt capital markets continue to weigh on activity

and later commented,

there's still a lot of uncertainty about when is the Fed going to stop and when are we going to start to see more stability. In the debt markets, we're seeing spreads tightening on the debt market, which is helping, and we're starting to see…people get to the point where they're…recognizing valuations at a more attractive level that can be executed on

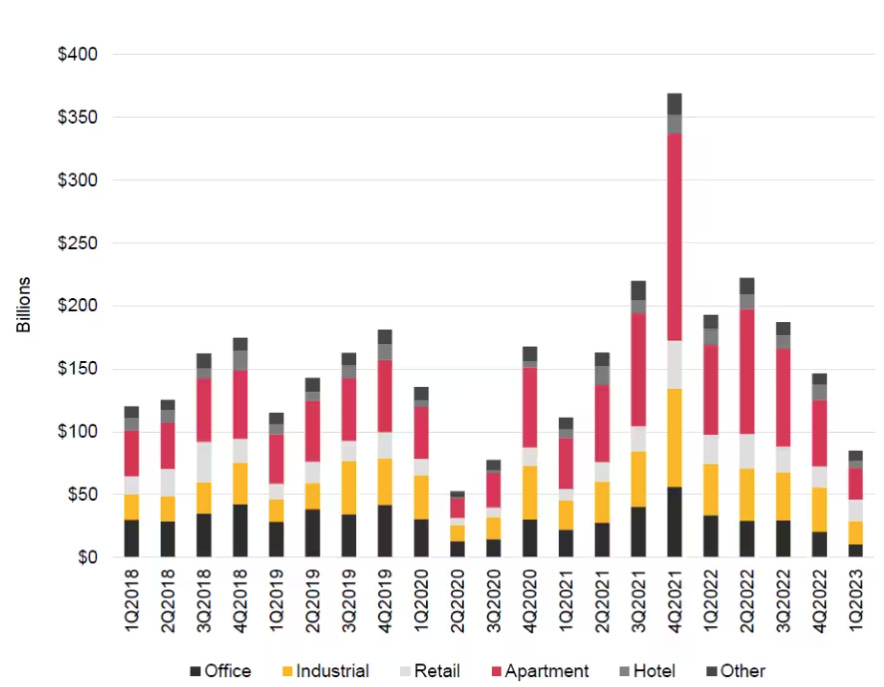

Of course Bridge is talking their book. So I take their positive commentary with a grain of salt. But let’s line it up against some market data. The chart above, from PwC, shows U.S. commercial real estate transaction volume by quarter. 2023 Q1 was the smallest quarter by volume in six years save for 2020’s Q1 and Q2, the two quarters closest to the onset of the covid pandemic.

Two conditions need to be true for CRE to bottom; mini banking crisis of Spring 2023 contained and fed rate hikes end in sight. I like both those bets

I expect investor interest to resume as CRE markets awaken. Above, I show Bridge’s quarterly fundraising on the left and quarterly transaction fees on the right. Bridge “earn(s) transaction fees associated with the due diligence related to the acquisition of assets and origination of debt financing for assets. The fee is recognized upon the acquisition of the asset or origination of the mortgage or other debt” As transaction volume picks back up, so will marginal investor interest.

4. Comment on Multifamily Fund V Performance

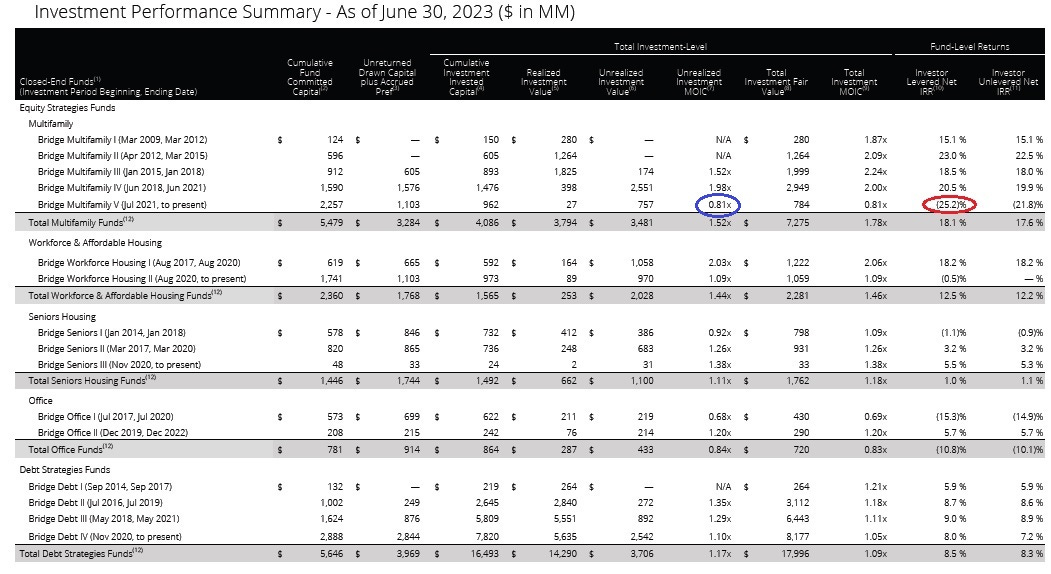

Speaking to fundraising and then performance is intentional. Asset gathering is a function of brand, distribution and performance. Bridge has a strong brand, enviable distribution and other than one big black eye, impressive performance.

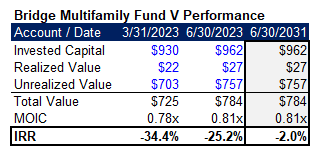

Above, I show Bridge’s fund level and strategy performance, with Multifamily Fund V, “MF V” circled in blue and red. Multifamily is the vertical Bridge is most closely associated with. At the end of 2022, Bridge took charges against MF V to account for higher cap rates. Blue circle shows the fund’s MOIC, 0.81x, reflecting a loss of $0.19 per dollar invested. As the fund has only been active for 2 years, the IRR, circled in red, is (25.2%).

Next, I show MF V’s summary results and marks at 03/31/2023, at 06/30/2023 and then I pull forward the most recent marks to 06/31, 10 years after The Fund’s launch. We can see that 0.81x MOIC translates to a (2%) IRR over 10 years. If Bridge realizes any value from the nearly $1B of capital they invested in 2021 and 2022 over the next 8 years, combined with the additional $1.5B they have yet to deploy, MF V likely ends up with fine performance, although still the worst among all prior Multifamily vintages.

No doubt MF V investors are frustrated. But I do not expect MF V’s performance to damage Bridge’s brand or hold back fundraising efforts.

5. Share Takeaways on the Markets Bridge Participates in

Below are a few takeaways from the 2023 Q2 earnings shared by CEO Jonathan Slager highlighting how Bridge is participating in various markets. Additionally, On August 8th, 2023, Bridge shared that their Workforce and Affordable Housing Fund II closed on a large purchase in the Boston area likely worth +$350mm.

Secondaries:

On the PE Secondaries front, our partners at Newbury have also seen strong transaction flow, despite headline volumes down 25% in the first half of 2023, according to Jefferies. Notably, that's off from a record highs set in the first half of 2022

…market activity picked up in Q2, reflecting an improving macroeconomic backdrop. Buyer demand is expected to be strong, heading into the second half of 2023 for both GP-led and traditional LP transactions.

Against that backdrop, Bridge deployed $490 million with most coming within our secondaries of credit strategies. As asset values have come down over the past year fund managers have taken increasingly realistic markets on their portfolio valuations, creating willingness to transact

Upcoming debt maturities:

…the large amounts of near-term debt coming due is pressuring asset owners to find solutions to fix broken capital structures. These owners in many cases own high-quality assets but with unattractive debt terms. These are exactly the kinds of situations where well capitalized investors like Bridge are positioned to act with conviction.

With $4.1 billion of dry powder to deploy into multifamily, logistics, workforce affordable and debt strategies, we're actively underwriting investment opportunities and our pipelines have been increasing from historically low levels experienced in Q1. This momentum is building in a number of strategies across our platform

Opportunistic credit purchases in AMBS and Debt Strategies

In AMBS, we bought $240 million of securitized residential credit at attractive pricing

In Debt Strategies, we opportunistically bought $273 million of floating rate CRE, CLO, and CMBS bonds during Q2 with ratings for that range from AAA to BBB, at a weighted average discount margin of SOFR +456

These highly risk-mitigated investment grade bonds have significant equity cushions and subordinate debt below them, and they've exhibited outside yields due to market volatility

5. Discuss Risks

I think the worst is behind is for Bridge. But rate increases exceeding expectations and Bridge’s fundraising faltering in the face of taciturn CRE volumes and each possible. The latter, fundraising faltering, is my guess for why Bridge’s stock wont’ work from here.

On the upside, I guess Bridge can outperform on the topline, as investor chase a resurgent real estate market, and on the bottom line with nascent investment strategies scaling into profitability.

How about doing your next one on $APO?