Progressive

A Lollapalooza of Profitable Growth

Progressive is an 83 year old business that at age 60 became the first insurer to sell directly over the internet. Over the next 20 years, Progressive’s market share of North American private passenger auto insurance grew from #15 to #3 and their Direct segment expanded to be The Company’s largest. More market share gains, momentum bunding home and auto policies as well as growth in Progressive’s Commercial Segment all position The Company for continued success. Progressive is not immune to the insurance industry’s cyclicality and competition, but their profit discipline and market position provide competitive advantages. Safety features included with new cars continue to improve and if they culminate with autonomous driving, may disrupt the auto insurance industry. But that day remains decades in the future. Frequency of accidents has not slowed, severity has increased and widespread adoption of AVs remains science fiction. Progressive’s stock should return at least 15% p.a. over a cycle, from a combination of profitable insurance operations and sales growth.

Results and Highlights

Leadership and Culture

Cyclicality and Competition

ADAS and AVs

Return Expectations and Closing Thoughts

Results and Highlights

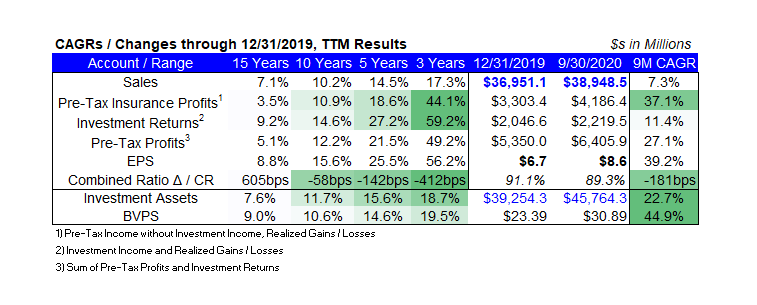

Progressive reports results across 4 segments; Agency personal auto, Direct personal auto, Commercial and Property. Agency and Direct account for 84% of Company sales, down from ~90% prior to 2015 when Progressive began writing Property insurance. The Commercial segment accounts for ~10% of Company sales. Progressive’s Agency, Direct and Commercial segments all operate profitably, with combined ratios (“CR”), 1 – profit margins, ranging from 85% to 95%. Over the 15 years leading up to 12/31/2019, Progressive’s sales, pre-tax insurance profits and investment returns (definitions above) grew at increasing rates, culminating in a 3 year stretch where EPS compounded at 56.2% p.a. from 2017-2019. Three factors explain Progressive’s extraordinary results:

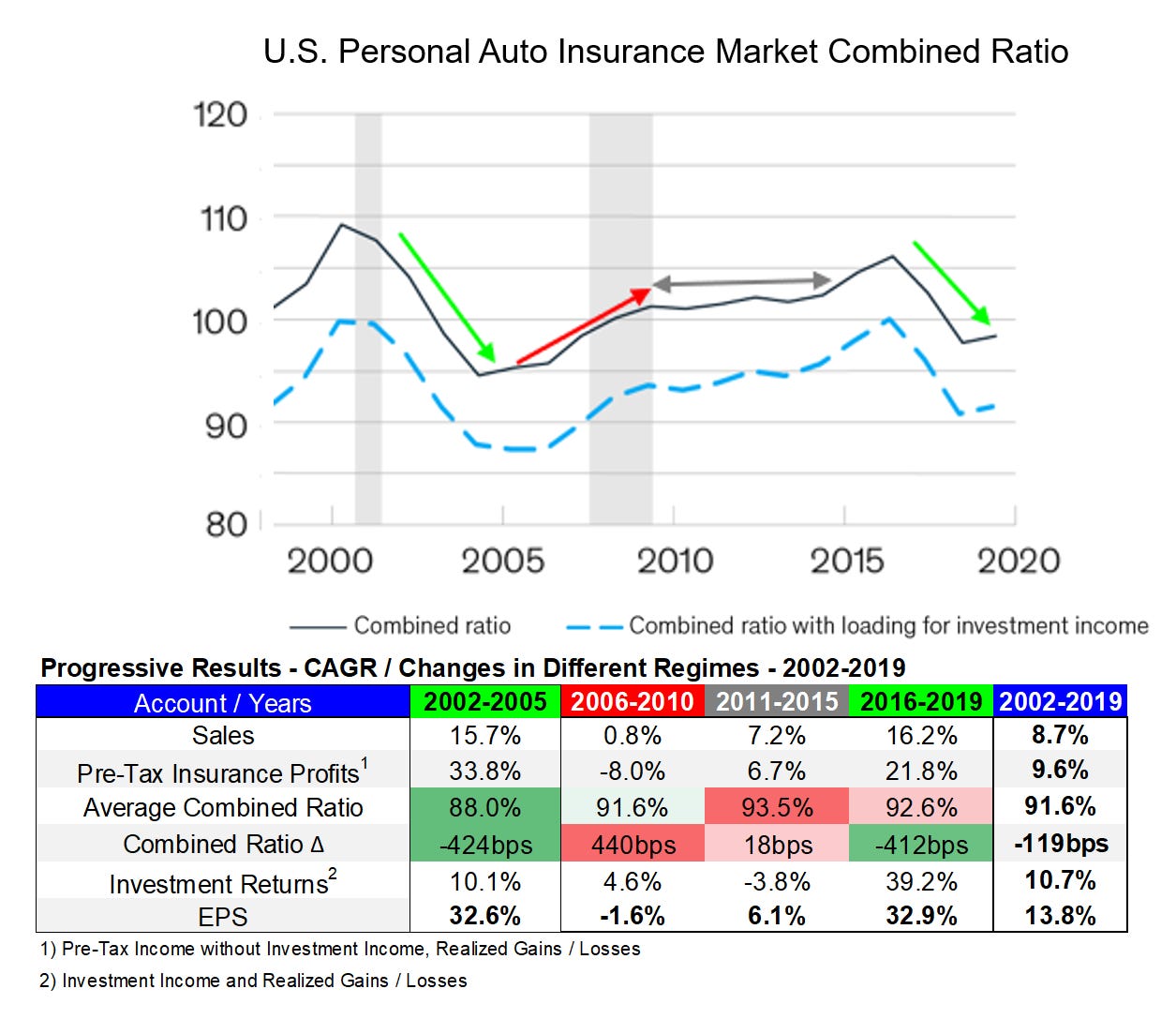

Favorable Industry Conditions. A well-managed insurance operation increases sales when margins are favorable and slows sales during periods of reduced profitability. Progressive capitalized on favorable industry conditions in 2002-2005 and 2016-2019. Sales were flat from 2006-2010 as the industries and The Company’s margins compressed. While conditions were mild from 2011-2015, Progressive’s sales and profits each grew ~7% annualized. Insurance industry conditions will inevitably worsen resulting in slower sales, lower profits, and less retained earnings to invest than during 2017-2019.

Investment Returns. Progressive’s investment returns are explained more by asset growth, as retained earnings are invested, than by percentage returns, which are generally mid-single digits. The Company’s surge in profits from 2017-2019, combined with a sharp drop in interest rates and equity market multiple expansion all combined to increase Progressive’s investment returns by 59.2% p.a. from 2017-2019. Low interest rates, challenging economic conditions and high equity market multiples forecast lower returns going forward.

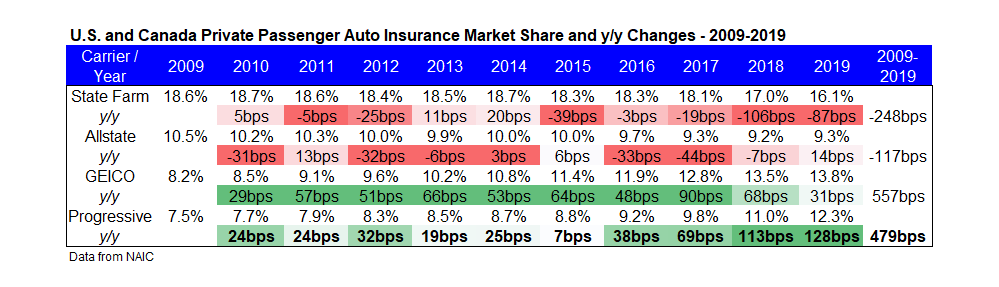

3. Market Share Gains. Insurance industry conditions will ebb and flow, projected investments returns are low, but Progressive’s market share gains over the past few years are sustainable. In the 10 years ending in 2019, Progressive increased their share of the U.S. and Canada auto insurance market by 479bps and in 2018, overtook Berkshire Hathaway’s GEICO as the largest share gainer.

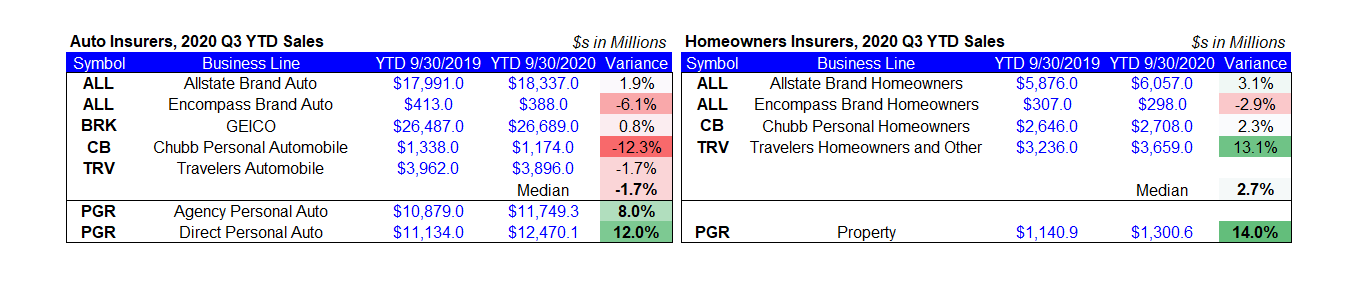

Through three quarters of 2020, Progressive has continued to take market share, with sales up 11% y/y and a TTM CR of 87.8%, inclusive of 2.5% of expenses paid out to policy holders in 2020 Q2 due to reduced driving during Covid-19 lockdowns.

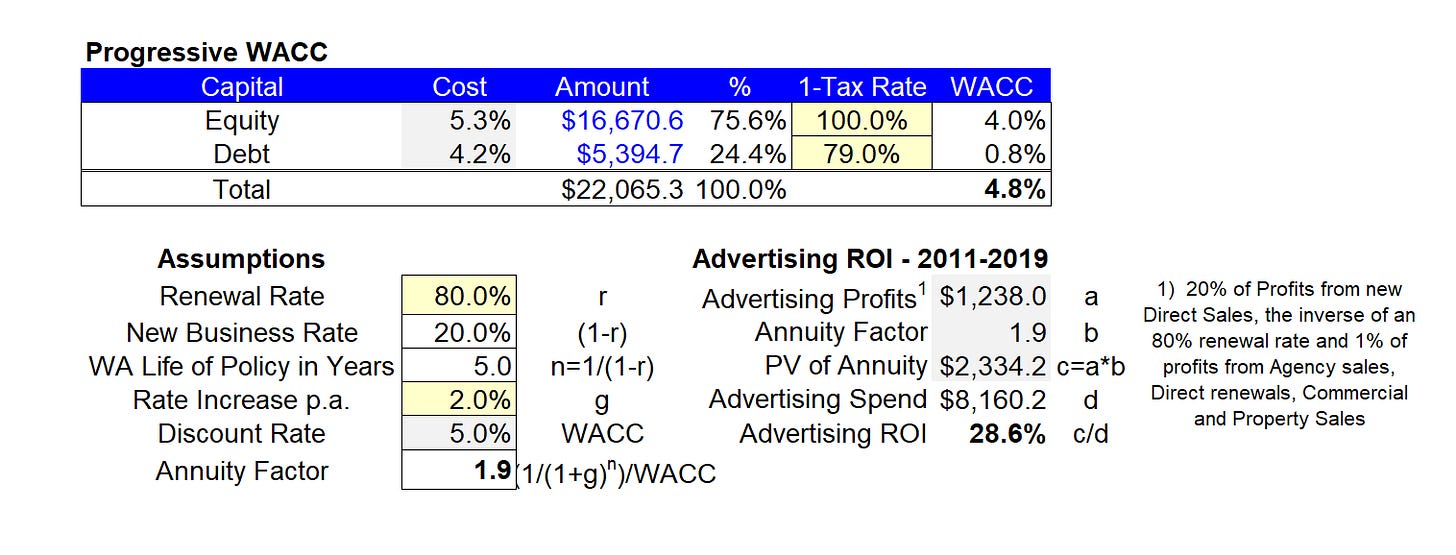

The Company’s Direct segment has grown sales 11.8% p.a. over the last 10 years, compared to Agency growth of 7.2% p.a. Direct sales are stimulated by successful advertising and marketing campaigns. Progressive increased their advertising spend 16% p.a. from 2011-2019 and using conservative assumptions within an annuity formula, generates almost 30% returns on their advertising spend.

During The Company’s 2020 Q3 earnings call, CFO John Sauerland, commented “…advertising (expense) is up 29% for the quarter…when you see us spending more in advertising…we are seeing opportunities to spend efficiently to bring in business…”

Sales of bundled policies has spurred growth across all four of Progressive’s segments. Within Agency, the Platinum program (link) offers higher commissions, marketing services and other benefits to Progressive’s top decile of agencies based on volume of bundled policies sold. From 2018-2019, bundled Agency sales grew 75%. Applications for bundled polices sold Direct were up 250% y/y at 12/31/2019

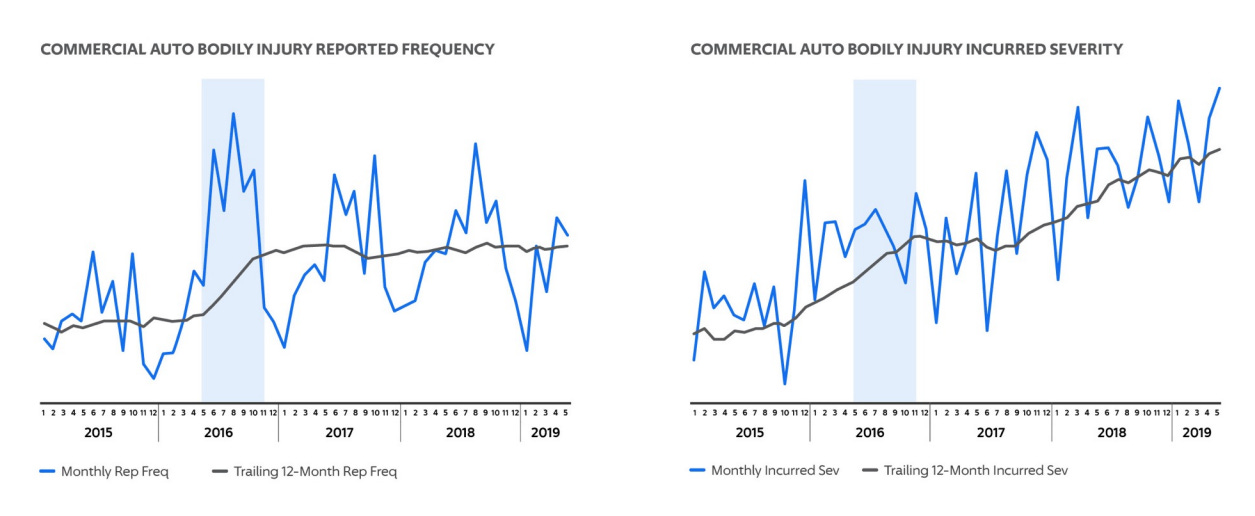

Progressive’s Commercial segment sales grew 30.2% p.a. between 2017 and 2019. The Company is the largest commercial vehicle insurer in the United States. Commercial auto insurance conditions were nearly perfect from 2015-2019; accident frequency and severity both increased, allowing The Company to raise rates by 24%. Highlights within the Commercial segment include

A 12/2017 federal mandate requiring that all commercial truckers use electronic logging devices, allowing Progressive to increase usage of telematics leading to more accurate pricing

Small business policy sales are up 3x from 2016-2019, in conjunction with enhancements made to Progressive’s online DTC business insurance portal, Business Quote Explorer, BQX

Leadership and Culture

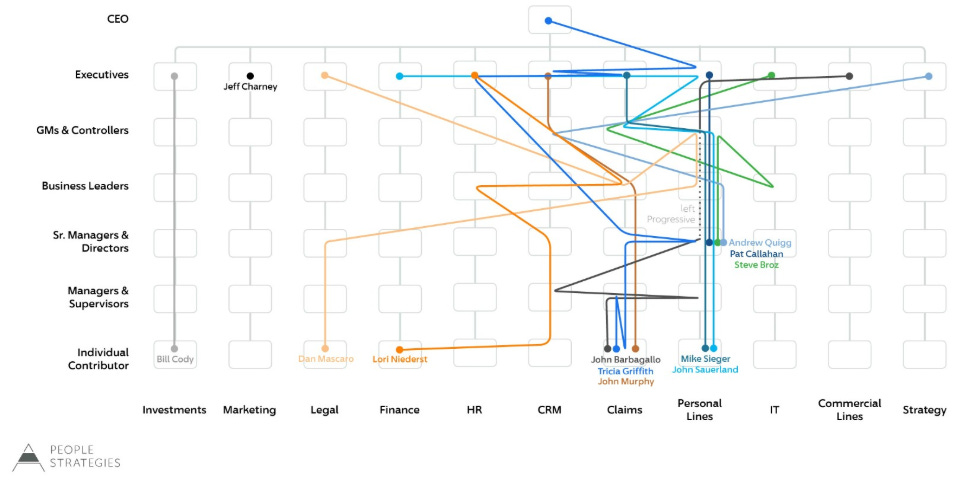

Since incorporating from a mutual in 1965, Progressive has been lead by only three CEOs; Jack Lewis, 1965 – 2000, Glenn Renwick, 2000-2016, and Current CEO Patricia Griffith since 2016. The Company prides itself on promoting from within; across their 12 business lines including CEO, 8 leaders joined Progressive as individual contributors. Among the 17 large insurers surveyed by Great Place to Work (link), employees ranked Progressive 4th highest and on Glassdoor awarded Griffith the 4th highest rating among her CEO peers.

The Company currently pays out between 25%-50% of net income as dividends and the stock yields 2.8% on TTM basis. Progressive spent $400mm buying back their own shares at ~12x P/E in 2011 but since then has only reduced shares outstanding by 4%. The Company’s single noteworthy M&A decision in the last decade was their purchase of a majority interest in American Strategic Insurance (“ARX”), a property insurer, in 04/2015 and the remaining interests in ARX subject to closing, announced in 05/2020. The Company’s first outlay of $875mm was ~50% of 2012 net income and equated to a purchase price multiple of ~1x sales, a fair valuation. Pro-forma for 100% ownership of ARX, Property sales are only 6% of Progressive’s totals. The Company has not written property insurance profitably in their first five years but homeowners policies are integral to The Company’s bundling success and Progressive’s legacy of profitable underwriting may yet emerge within their Property segment.

Cyclicality and Competition

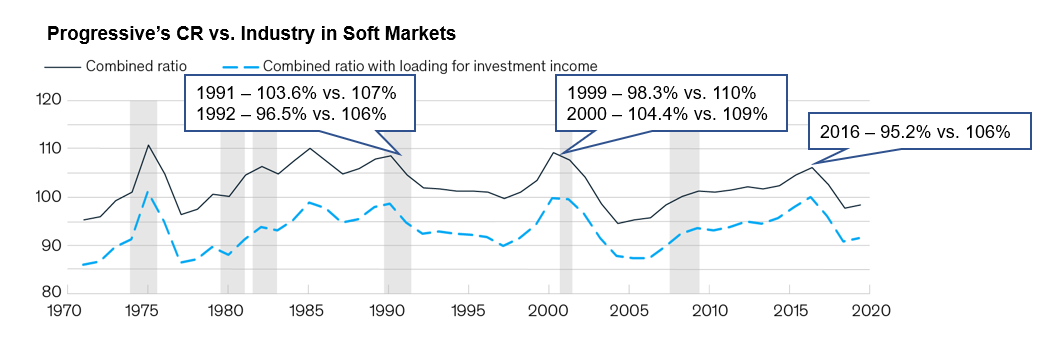

Insurance cycles between soft and hard markets. Low prices result in poor margins leading to rate increases and wider margins while allowing a low-price operator to restart the cycle. Three soft markets have occurred in the last 30 years; 1990, 1999 and 2016. Progressive owners should be encouraged that the most recent soft market in 2016 was 5% better than previous episodes and that The Company fared better relatively, outperforming the industry by ~11% compared to ~7.5% in 1991-1992 and 1999-2000. From 12/31/1999 to 11/17/2020, Progressive’s stock delivered total shareholder returns of 13.1% p.a., including two soft markets and the global financial crisis from 2007-2009. Competition is intense in the insurance industry; churn is high, barriers to enter are low and the product is commoditized. The Company’s leading market position helps them fend off challengers such as Lemonade and Root whose combined sales are ~1/6 of what Progressive spends on advertising alone. Most auto insurers price policies with a 100 CR goal, breaking even, providing an advantage over Progressive in theory. In practice, Progressive competes and wins against their competition by pricing policies better, paying lower commissions to agents, 10% compared to industry norm of 15%, as well as efficiencies and savings from Direct sales.

ADAS and AVs

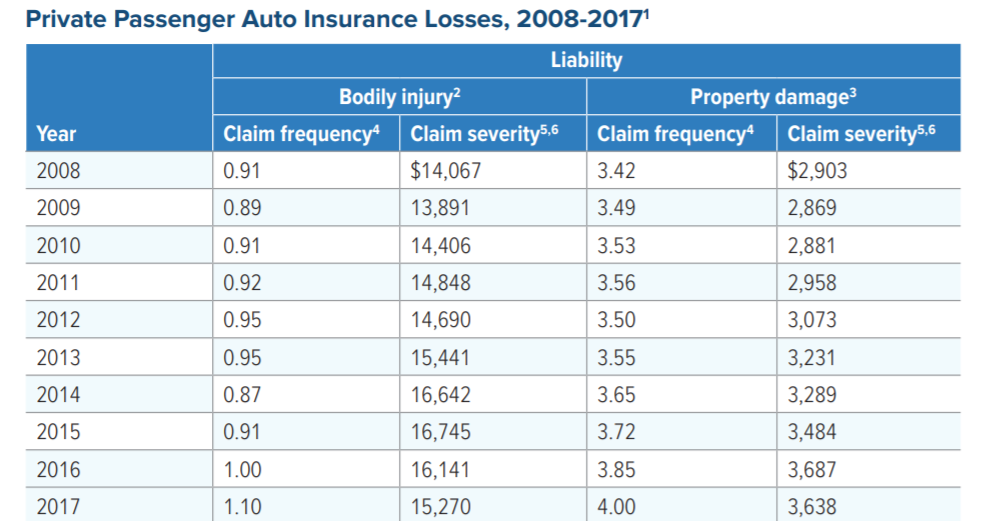

Beginning with anti-lock brakes systems in the 1970s, manufactures have shipped new vehicles with Advanced Driver Assistance Systems, “ADAS”. Current features prevent collisions, maintain safe distances, switch lanes and provide parking and reversing assistance (link). ADAS features rely on electronic sensors; camera, Lidar and radar, which increase the cost of vehicle repairs and support insurance price increases. From 2008-2017, claims severity for property damage increased 25.3% but frequency also increased 17.0%. As ADAS becomes more widely adopted, frequency of crashes and insurance claims should decrease, although there is no evidence yet. ADAS systems may evolve into autonomous vehicles (“AVs”) in the future. Mainstream adoption of AVs likely would reduce demand for auto insurance, due to safer conditions, or if the policy owner shifts to OEMs from passengers. McKinsey predicts autonomous vehicles will be mainstream in 20-30 years (link), when #fintwit also predicts auto insurance to become unnecessary:

Return Expectations and Closing Thoughts

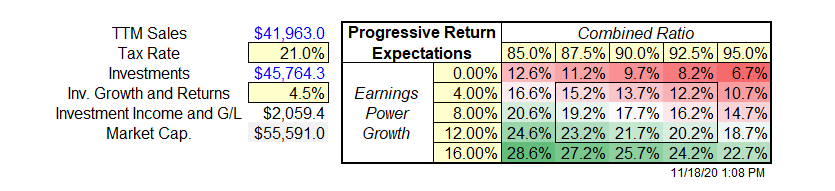

Progressive’s returns are a function of their CR, investments growth and returns and The Company’s growth in earnings power.

Progressive’s combined ratio has ranged from 85% to 95% over the past two decades

Progressive’s investments are primarily short duration fixed income instruments that most recently yielded 2.2% on an after-tax basis as well as a small amount of stocks indexed to the Russell 1000. Investment returns will be slightly higher than the yield on their fixed-income portfolio, about 2.5% after-tax plus growth of ~2% p.a. from retained earnings

Progressive’s shareholders earn a yield, the sum of after-tax insurance profits, sales x 1-CR x 1-tax rate, plus investment income and gains/losses, divided by The Company’s market value of equity

Progressive’s earnings power growth is most easily forecasted by sales growth, as margins are a function of industry conditions. The Company’s sales growth has ranged from -1.8% to 27.6% over the past two decades but a narrower range of 0% to 16% is reasonable to use.

Yield plus growth forecasts Progressive’s shareholders will earn double-digit annualized returns, between 15%-20%, without including the positive effects of dividend reinvestments or changes to the stock’s multiple. Progressive’s stock is currently trading 10% cheaper on a P/E than over its prior 10 years, 14.0x compared to 15.5x.

I began exploring Progressive after hearing Geoff Gannon speak highly of their underwriting a few years ago. The Company’s recent results, a lollapalooza, where shocking to me and only made sense when viewed in the context of an industry cycle. When you can reasonably project 15% returns p.a. over a cycle, it is necessary to ask, what do I believe that the market does not? In Progressive’s case, the market may be skeptical that The Company can maintain CRs of 90ish and continue to take share. The market may forecast the death of the auto insurance industry sooner than my guess of 30 years out. Progressive’s legacy of profitable growth and their DTC success position the company perfectly for 2020, when e-commerce was accelerated years into the future, as well as for the decades ahead.