How about a Thought Experiment?

Terravest is a motley crew of businesses. Its subsidiaries manufacture tanks used to transport and store gases, HVAC equipment and machinery used to operate oil and gas wells. Also, Terravest owns 60% of an oil and gas service business operating in Western Canada. We will dig into all of that. But first, how about a thought experiment?

Mark Leonard, the founder of Constellation Software, posed the above thought experiment in his 2015 President’s Letter. But it was not just an experiment. Since the mid 2000s, Leonard’s Constellation has acquired niche software businesses, nearly all of the high margin and low growth variety, and from them generated attractive IRRs. Terravest too acquires high margin, low growth businesses and from them generates attractive IRRs.

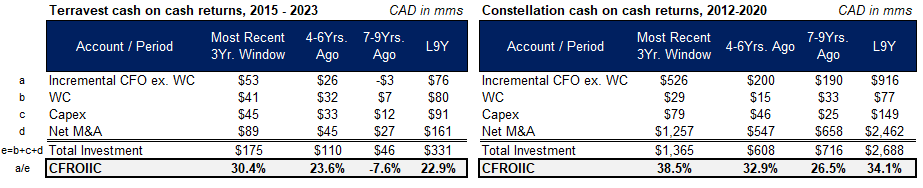

Above, I show cash returns on incremental invested capital for Terravest and Constellation, see section 7 for details on these calculations. I measure Terravest’s relevant history, from FY14 through their most recently completed fiscal year FY23. I compare those 9 years versus 9 years of Constellation’s results ending in their FY 2020, just prior spinning off Topicus, to avoid accounting adjustments. Before comparing their returns, which I do below, two details stand out, (1) Compared to Constellation, Terravest’s ongoing investment needs in the form of working capital and capex are greater, as a percentage of total investments and (2) Terravest’s results are improving.

Above, I show the same 3Yr. cash on cash returns over rolling three year windows. Constellation’s returns were fantastic, not surprisingly. Terravest’s returns were OK, then good, and recently, very good. Each of Terravest’s last five rolling three year returns were above 20%, with the last two above 30%. That, combined with the stock’s small market cap. and low valuation, and mix of unique businesses were what initially got me interested. What convinced me to first bid on the stock was the first of two conversations I had with Dustin Haw, The Company’s CEO, in January 2023.

Table of Contents

Outsiders: Betting on and with Haw, Mitchell and Pellerin

Cylindrical steel crap: Terravest’s businesses

Fast fire: The case for Canadian nat. gas and oil

Slowly then all at once: Home heating oil and standard efficiency boilers in the 21st century

Decline and deploy: Two valuation frameworks

Quality without Quality: portfolio considerations and closing thoughts

The bet. The bet is that Terravest continues to acquire businesses for low single digit multiples of earnings; And, that they get better at it. Better at evaluating and closing deals, better at improving businesses soon after acquiring them and better at operating them in steady state. I am confident this bet hits based on Terravest’s leadership trio and the results they have generated working together over the last 10 years. We dig into management, their acquisition program and other capital allocation decisions they have made in section one.

The rub. There are a few. The first is Terravest’s exposure to the Canadian nat. gas and oil industry. Long term, renewables gaining share as sources of energy is scary for Terravest. But The Company’s exposure here is specific to Canadian production of nat. gas, and oil. So the question is not, will renewables continue to gain share, we know they will, but rather, how will Canada’s exploration and production, usage and export of nat. gas and oil fare over the intermediate term? We explore that question in section 3. In section 4, we explore The Company’s sale of home heating oil storage tanks and standard efficiency boilers. Home heating oil is dying slowly as customers churn while standard efficiency boilers will eventually be regulated out of use. Did Terravest invest little enough, and generate enough cash in the interim to make a decent returns on their home heating oil and standard efficiency boiler investments?

The prize. The prize is big. Terravest is currently worth $1.4B with a young but seasoned leadership trio. Over the past 10 years, that trio has executed against a playbook with eye-watering success. What must be true for a successful decade from here? (1) a low or reasonable starting valuation. Terravest was cheap for a long time and I expect it will be again here and there, but not again months and years at time. (2) continued execution of the acquisition playbook, which leads to two questions Is the pond they are fishing in big enough? I think it is. With almost 500 possible acquisition targets, Terravest will stay busy for a long time. And Does Terravest have or can they gain the human capital necessary to scale? I unpack these questions in section 5.

I end with closing thoughts in section six. Terravest is nearly a 20% position for me and the only stock I own in either of the energy or industrial sectors. Terravest is not a perfect business and I don’t think shares are attractive at the moment. I wrote this to better understand what I own, to organize a lot of stray thoughts floating around my head, and to be prepared to buy more if the markets give us that choice again.

Programming notes. All dollars are in CAD. all years are Terravest fiscal years that end September 30th of that calendar year.