Freedom of Rate and Form

A Quick Look at Ryan Specialty, $RYAN

Only two years after retiring as CEO and Chairman of Aon, the insurance brokerage he built and led over 41 years, Patrick Ryan started over. In 2010, Ryan formed Ryan Specialty, a wholesale broker of excess and surplus insurance. In July 2021, RYAN IPO’d on the NYSE. In this short write-up, my goals are to answer the below questions:

How does excess and surplus insurance fit into the U.S. insurance value chain?

What trends are RYAN rooting for?

Who besides 85 year old Patrick Ryan is in charge?

Where are we in the excess and surplus insurance cycle?

What happens in a recession?

What are reasonable return expectations for prospective shareholders?

How Does Excess and Surplus Insurance Fit into the U.S. Insurance Value Chain?

First, what is Excess and Surplus (E&S) insurance? Nationwide describes E&S as,

…a specialty market that insures things standard carriers won’t cover. The difficult or high-risk exposures in which E&S carriers specialize may range from a mobile home or a day care center to a multinational oil company. And anything in between

In their 07/2021 Prospectus, RYAN expanded,

Compared to admitted carriers, E&S carriers often have more flexibility to quickly adjust coverage terms, pricing, and conditions in response to market needs and dynamic…commonly referred to as ‘freedom of rate and form’…with greater flexibility, E&S underwriters can tailor insurance products to meet emerging risks, the needs of insured, and the risk appetite of carriers

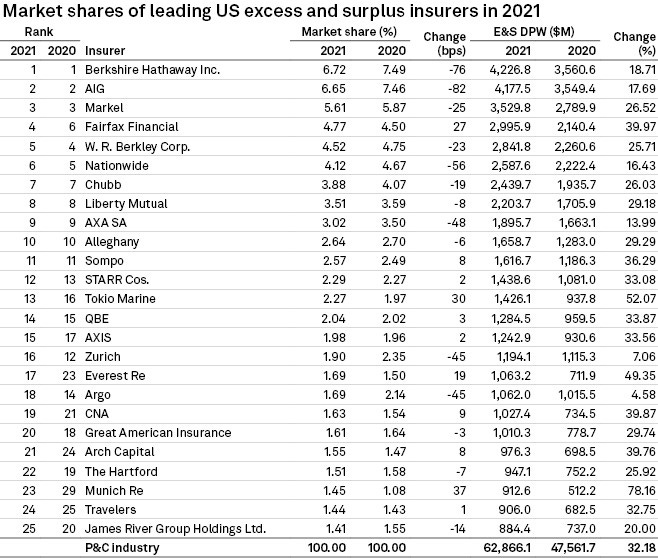

Who writes E&S insurance? According to S&P Global,

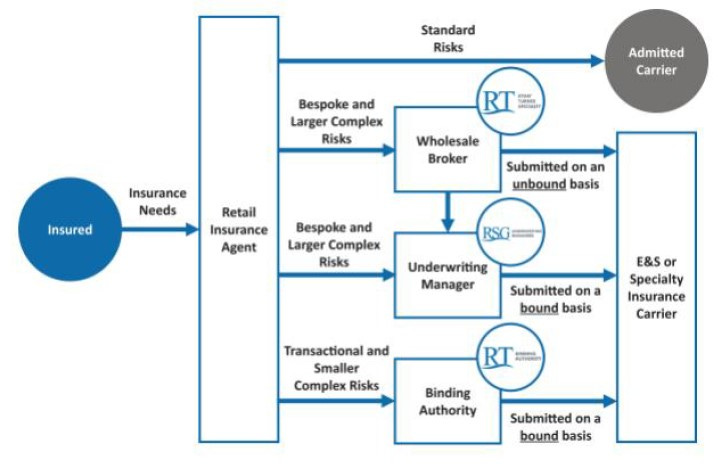

In their 07/2021 S-1/A RYAN depicted how E&S fits into the U.S. insurance value chain as:

What Trends are RYAN Rooting For?

At Goldman’s 12/2021 Financial Service conference, Ryan identified three trends significant to Ryan Specialty’s growth (numbering mine):

We started back in 2010 with an idea that the E&S market was about to undergo some serious change…that…is all going to be positive for those…prepared to deal with it. So we set up a…wholesale broker specializing in high hazard risks…we believed (1) that there was going to be a growing phenomenon of delegated authority for underwriting, administration and distribution…the world was getting a lot riskier…and more of that risk was going to find it’s way in(to) the E&S market

Ryan continued,

(2) And secondly…there was a phenomenon going on where retail brokers have been using far too many wholesalers…we thought that would be changing and sure enough, it did right after we started and went from 10-12 wholesalers down to 3

And lastly,

(3) And then there was an additional phenomenon of the consolidation of retail brokers…and that consolidation was starting to get quite serious…over this past 11 years, it’s really accelerated and in high gear right now. What that meant was our clients would be getting larger

I was able to verify #1 and #3:

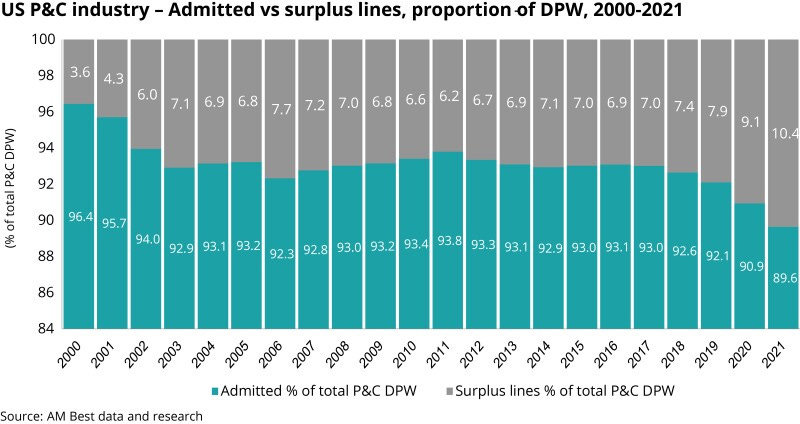

AM Best data shows that Ryan’s 2010 thesis that E&S would take share from admitted lines was correct, albeit late. In 2010, E&S direct written premiums (DPW) were 6.6% of admitted lines and did not exceed 7.0% until 2018. From 2018 - 2021, E&S gained 340bps of DPW market share from admitted lines.

Optis Partners, an M&A shop specializing in insurance brokerage transactions, shows that Ryan was correct in predicting continued consolidation amongst insurance brokerages. Whether the now larger brokerages themselves consolidated wholesale brokers, like RYAN, from whom they source E&S policies, is yet an open question.

Who Besides 85 Year Old Patrick Ryan is in Charge?

Patrick Ryan is 85 years old and so forces prospective shareholders to consider who may run Ryan Specialty next. Three current executives officers are worth familiarizing ourselves with as current and future leaders of RYAN; Timothy Turner, Nicholas Cortezi and Jeremiah Bickham, biographies from The Company’s 07/2021 prospectus:

Where are we in the Excess and Surplus Cycle?

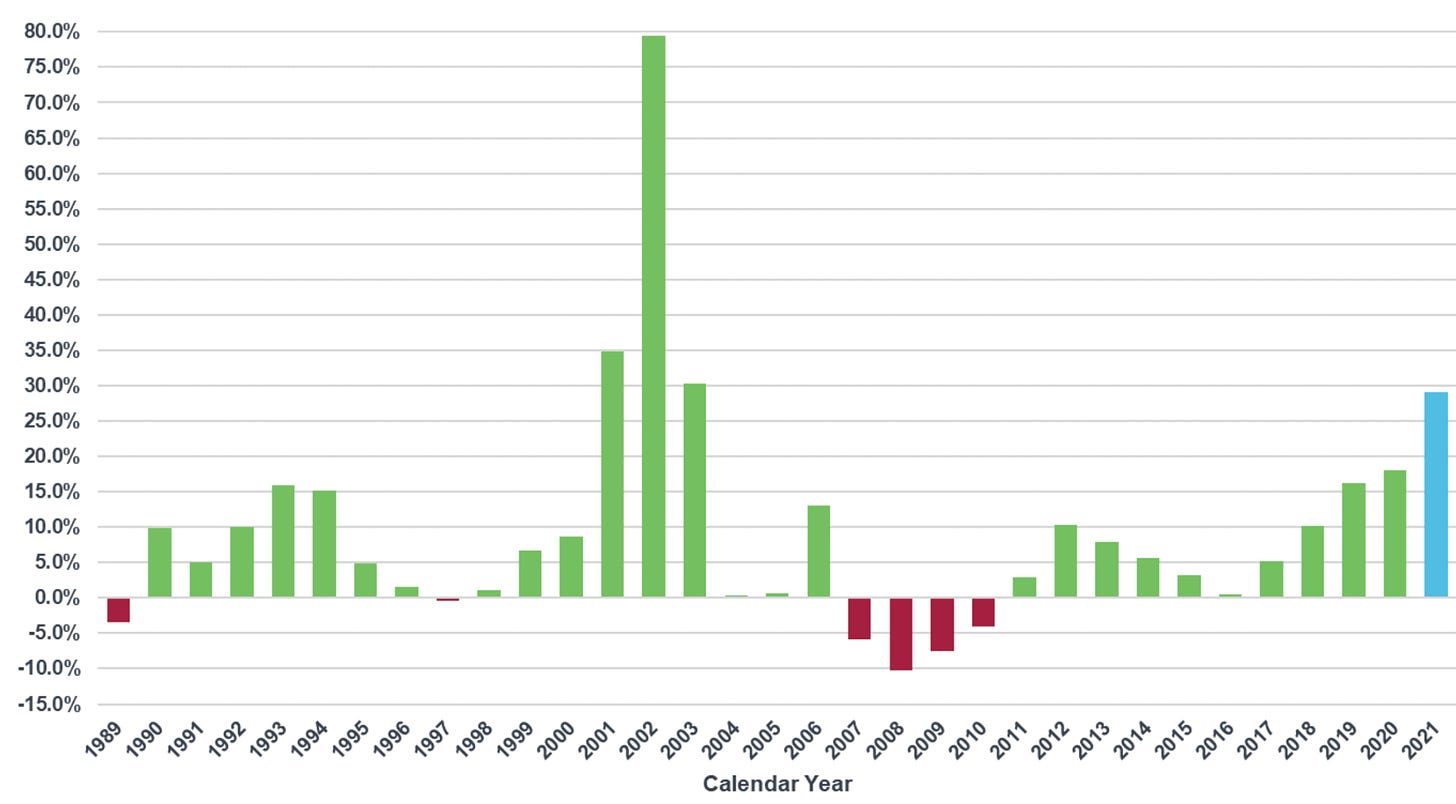

A great place, from the perspective of carriers and wholesalers! Over it’s 11 years, RYAN has operated in a favorable capital cycle for E&S lines, particularly in the past few years. Shareholders should not expect such conditions to persist indefinitely.

What Happens in a Recession?

Ryan believes his business is insulated, to a degree, because,

… almost the vast majority of our business are compulsory, either state regulated, like auto or comp. But financially regulated in the sense of a lender demands insurance in so many parts of the coverage that it becomes compulsory…(9/8/2022 KBW Conference)

Ryan cites The Companies growth through 2020 as a positive example of growing through a recession, but layering on the 15% y/y rate increase the E&S market experienced, it’s fair to wonder more how RYAN would perform during a soft market than a recession.

What are Reasonable Return Expectations for Shareholders?

RYAN has communicated low double digit top-line growth with significant margin expansion beyond 32% EBITDA margins as reasonable expectations for shareholders. Both seem aggressive, although not impossible. RYAN has only operated in a hard market, hence their organic revenue growth has looked great and their forecasts seem believable. Maybe over a cycle, high-single digit revenue growth is a more reasonable guess. The Company’s margins forecasts are also aggressive. RYAN’s much larger and more diverse peers; AJG, AON, BRO and MMC all have net income margins between 10-20%, whereas RYAN is forecasting implied net income margins nearly double that. RYAN is small enough and run by capable enough leadership that I do not immediately disregard their margin forecast, but am interested to monitor its development. Lastly, M&A. Like Aon, Patrick Ryan is using RYAN as a vehicle to consolidate a a fragmented industry. Ryan shared,

Over the years, Tim and his team and lots of our leaders have cultivated potential opportunities like crops, like All Risks, which we bought in 2020, the fourth largest wholesale broker. That took years of cultivation. So there’s cultivation going on with family businesses or entrepreneurs that haven’t been ready to sell but they’ll get there…we’re not the kind of acquirer that buys large numbers of companies, small ones…our business is selecting really unique, talented, talent laden differentiating companies that bring greater solutions…We can have a very big one, like All Risk, which is over a $1B in purchase price, and then a smaller one like Crouse, but we’re not going to have dozens of them a year…there’s a robust market out there that we’re farming and that emerge at different times (12/8/2021 GS Conference)

Putting it all together, high single digit revenue growth through a cycle, with margin expansion and accretive M&A can result in double digit returns for RYAN shareholders. RYAN currently trades for 30.5x and 19.1x my estimation of their NTM net income and adjusted EBITDA respectively.

Really interesting write up! Thanks so much for sharing it. I’ve always like the insurance industry and enjoy learning more about it